Wang v. Bo - preview of coming clashes!Got it via a friend who read Krugman's post on this post. Here's the Krugman's site, and here's the original post.

Wang v. Bo - preview of coming clashes!Got it via a friend who read Krugman's post on this post. Here's the Krugman's site, and here's the original post.

Hempton's description is correct, by everything I know. He's just a bit much on the name calling ("China is a kleptocracy of a scale never seen before in human history.") Krugman reads the post and sees, per his usual pessimism, a system bound to implode.

What Hempton describes is a form of capital expropriation of the Asian variety. It is different in style than what happened in the West (super-low wages) because it focuses on abusing the average Chinese citizens' savings to prop up state-run enterprises while allowing the elite to siphon off extraordinary profits. But understand that Japan and South Korea did much the same, so yeah, the scale is magnificent but the dynamic is familar.

The system is right for China in terms of preventing instability and allowing for an overall rise in GDP per capita that generates a massive middle class (in sheer numbers, less so as a percentage of total population). It'll be right until the people can't stand it anymore (populist anger) or the global economy can't stand it anymore (the export-driven growth and general mercantilism) or the national economy can't stand it anymore (the heavy reliance on public investment).

Now, Hempton's take is all righteousness to point of sounding like a Marxist, which is correct enough and ironic enough, but, you know, Marx was right on a lot of things. He just couldn't imagine a political system smart enough and flexible enough to bend at the point of near-breaking. In the West, he didn't believe democracies could pull it off - except they did.

Now, we Westerners can't image single-party states in the East managing the same. Except Japan did actually move off the model - to a certain extent. South Korea has done it much better. China approaches the historical moment when it must happen; when it must turn into a system ruled by the middle.

Will it become a recognizable democracy? So many experts will tell you that cannot happen due to Asian civilization. I personally find that bullshit and always have. It won't resemble Western democracy but it will define - just like Japan and South Korea have - Eastern democracy (and yes, that concept makes some experts' heads burst into flames once they scream, "INCONCEIVABLE!").

Here again, I think Marx is right in saying that capitalism is so revolutionary that it remakes societies. It just does at the pace of generational change - duh!

China's system works in expanding capitalism throughout China and creating tremendous (and real) growth and in networking China with the global economy. It works just like America's system of global governance through the absorption of export-driven growth and debt-financing-as-a-reserve-currency and providing (with all that cheap money) military Leviathan services worked for expanding globalization for about 25 years in the long expansion from the early 1980s through the late 2000s. It works until it works itself into an imbalance that requires correction and new rules and new policies, etc. It works until it succeeds too much and thus stops working - simple as that.

What always happens when a system like either of those reaches its apogee of success and no more success can be had is that the critics come out in droves and go ape-shit in their condemnations. Suddenly, not only is the created imbalance bad, but the entire system is evil and all that came through it is viewed as a complete fraud.

This is way over-the-top analysis and Hempton's piece is chock full of it. But it's this kind of Cassandra crying that signals you're reaching the endpoint and system-failure-triggering-revolutionary-solutions is nearing.

So yeah, an accurate description, and yeah, way over-the-top in its gloom-and-doomism.

Why have the Chinese people allowed this system to unfold and expand and reach such imbalance? Because it's delivered the country and a great deal of them a far improved life - simple as that.

Why will the Chinese people progressively rebel against the system now and in the future? Because it's reached the point where it stops working as well as it did in the past - in large part because China hits the same shift point between extensive and intensive growth that all risers hit - again, simple as that.

Yes, we can call it all sorts of names and point fingers, and pull our hair, and predict all manner of doom.

But you know what? China ain't going anywhere. The system will adapt.

No, it won't be pretty, but the Asian version of capitalism adapts just like the Western version did. Eventually the rich find they have enough and want to protect their wealth through enhanced social stability - even more equality - if that's what it takes. Eventually, the rank-and-file see that they've eaten enough bitterness on behalf of China so that they deserve a better cut.

If China hits the same roughly-five-decades-mark on single-party rule and then spasms toward democracy, like so many other Asian nations have in their individual "rises," then that democratizing point probably arrives in the 2020s (but between now and then, expect tons of apres moi, le deluge handwringing that will mentally prep the Chinese people for the coming change). I am convinced China cannot make it past that point in history and wealth creation (by 2030, a per capita GDP of about $20,000) without going full democratic (always with some Asian/Chinese twists, mais oui).

But, as we know, China is doing everything so fast in comparison to Japan and South Korea and other predecessors. But it's also far larger (which is why EVERYTHING in China is the "biggest in human history" - puhleaze!), meaning we can't forget the extensive growth still to come in the interior provinces, where well over a half-billion poor people live.

China's rich coast must integrate its still-impoverished/poorly developed interior just like the rich-and-rising American East integrated its Wild West from 1865 to about 1900. Those were wild and crazy years, full of booms and busts and robber barons galore. But that mounting angry populism eventually segued into a progressive era of tremendous progress, one that cemented the middle class as the republic's political center.

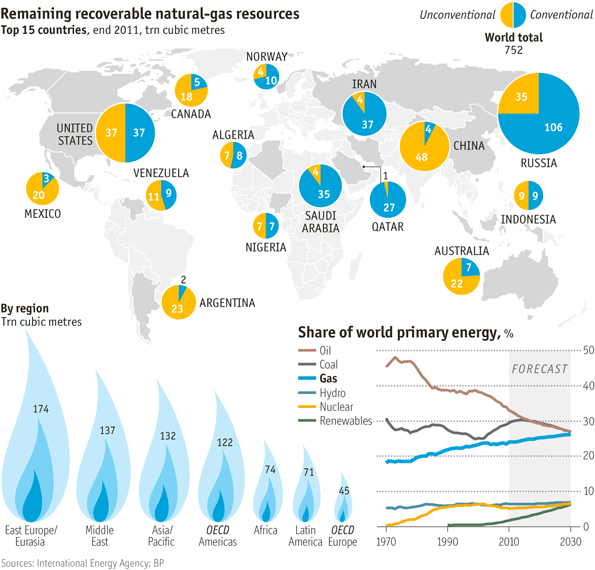

To me, the most fascinating question out there (besides the Fracking Revolution in energy) is, How fast does China's democratization process arrive? China still has to make that interior growth happen, but, because it lacks true democracy, it's got this restive coast. Already, you see this dichotomy reflected in the Party between the coastal, cosmo "princelings" and the far-more-red interior hard-core types more rooted in the Party's past. You also saw it in the dramatic showdown between Chongqing's Bo Xilai (with his Maoist revival) and Guangdong's Wang Yang. This is classic red state-v-blue state stuff!

So yeah, the big political fights (and accompanying democratization) are coming. They'll just unfold within the Confucian mindset of the system, which will actually help a great deal in keeping this thing from exploding.

So yeah, China is deep into that journey of transformation that we've seen so many predecessing systems experience as "punishment" for their successful rises within capitalism. That's why, in my mind, there's no question that between now and 2030, all the changes desired by the West and many Chinese will come to pass - albeit in a manner that is particularly Chinese. So no, I do see the power of culture and civilization in the "how" part; I just don't think it prevents or obviates the "what" part.

So read Hempton's piece. Read Krugman's blog. Just understand that none of this is all that unprecedented. It's just the latest chapter in capitalism's expansion. Yes, it's a crucial one alright. You add China to the mix and you go from a "global economy" to globalization - pure and simple. But China won't be the last story in this epic cycle.

So don't wear yourselves out on fear and hyperbole - as "SHOCKING!" and entertaining as these "discoveries" are.

Friday, July 20, 2012 at 10:57AM

Friday, July 20, 2012 at 10:57AM

China,

China,  LATAM,

LATAM,  Russia,

Russia,  US,

US,  energy,

energy,  extractive industries | in

extractive industries | in  Chart of the day |

Chart of the day |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article