The only solution to our immigration "crisis" that matters

Tuesday, July 24, 2012 at 10:04AM

Tuesday, July 24, 2012 at 10:04AM

In the 1950s, there was a scare (mostly in NYC) about the seemingly endless influx of Puerto Ricans (you remember "West Side Story" and Leonard Bernstein's attempt to dance the problem away?), but the stream thinned out dramatically when the local GDP per capita reached somewhere in the region of 40% of the US's number. When it got to that point, all things being equal, PRs preferred staying in PR.

This dynamic is well know and has been pointed out many times before in print.

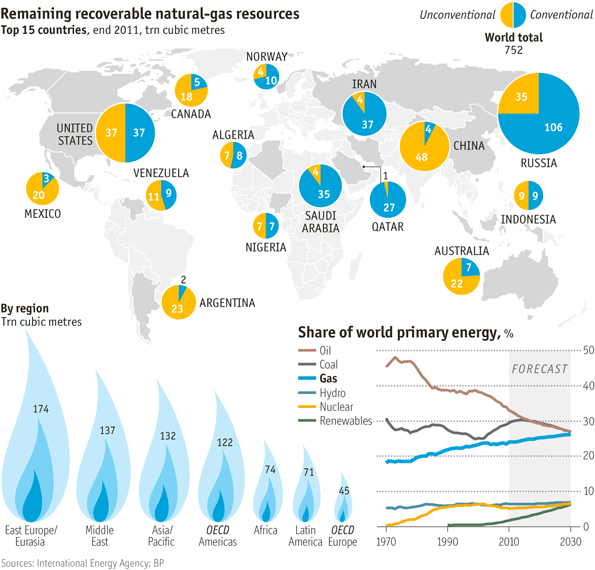

Point of these charts from WAPO story about how returning migrant workers are bolstering Mexico's middle class is that we are reaching that point on Mexico, where - commensurately and with no surprise - the birth rate falls dramatically.

No, it doesn't end the flow of immigrants from LATAM writ large, but the point is made: as long as a huge opportunity disaparity exists, they will come. If you want a more manageable flow, you need to whittle down that delta along the lines I just described.

From the story:

For a generation, the men of this town have headed north to the land of the mighty dollar, breaking U.S. immigration laws to dig swimming pools in Memphis and grind meat in Chicago.

In the United States, they were illegal aliens. Back home, they are new entrepreneurs using the billions of dollars earned “on the other side” to create a Mexican middle class.

The migrants “did something bad to do something good,” said Mexican economist Luis de la Calle.

Where remittances from El Norte were once mostly used to help hungry families back home simply survive, surveys now reveal that the longer a migrant stays up north, the more likely the cash transfers will be used to start new businesses or to pay for homes, farm equipment and school tuitions.

From Santa Maria del Refugio, a once rural, now almost suburban, community of 2,500 in central Mexico’s Guanajuato state, young men have gone to the United States seeking the social mobility they could not find at home.

Their money, and many of the workers themselves, have since returned, as the U.S. economy slowed in the global recession. For the first time in 40 years, net migration is effectively zero. About the same number of Mexicans left the United States last year as arrived. Migration experts expect the northward flow to pick up again as the U.S. economy improves. It is also possible that as Mexico provides more opportunity for upward mobility, some potential migrants will stay home.

In Santa Maria, dollars scrimped and saved in the United States have transformed a poor pueblo into a town of curbed sidewalks, Internet cafes and rows of two-story homes rising on a hillside where scrawny cattle once grazed.

“Look at this place — it’s practically a city now,” said Roberto Mandujano, 50, who moved back to his home town and opened a hardware store five years ago. “There was nothing here when I left.”

Mandujano is a member of a new demographic in Mexico, the anxious, tenacious, growing middle class who own homes and cars and take vacations. They see the United States more as a model than an exploiter.

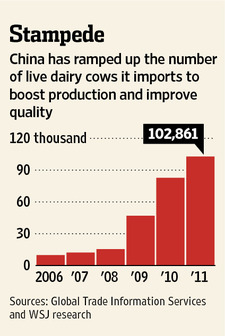

Another argument for the US focusing more on amping up growth across LATAM: If we want to grow long-term above what history says we should be restricted to as a mature economy, then the best way to achieve that is for countries in our neighborhood to be experiencing rapid growth. [NOTE: this is ultimately why China will need to cool it on seabed territoriality disputes, but no, this logic does not rule out Beijing's stupid behavior in the meantime - as humans have an unlimited potential for letting idiocy trump logic.]

The resurrection of cheap energy in the US is the lure we should use in such an integration effort, and yes, we should most definitely be thinking about adding more stars to our flag.

You either get busy growing or you get busy shrinking in this globalized world.

China,

China,  LATAM,

LATAM,  Mexico,

Mexico,  US,

US,  connectivity,

connectivity,  demographics,

demographics,  immigration | in

immigration | in  Chart of the day,

Chart of the day,  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article