The "Climate Changes Everything" June 2019 Brief

Sunday, July 7, 2019 at 8:41PM

Sunday, July 7, 2019 at 8:41PM 65-minute presentation delivered in Idaho to a convention.

Sunday, July 7, 2019 at 8:41PM

Sunday, July 7, 2019 at 8:41PM 65-minute presentation delivered in Idaho to a convention.

Monday, January 7, 2019 at 10:53PM

Monday, January 7, 2019 at 10:53PM

Worth getting for a nice, non-hyperbolic overview of the world and its presently most-pertinent power dynamics.

From the intro:

GlobalWonks is a technology-enabled platform with on-call access to a growing network of over 1600 global business and policy experts (wonks) located in more than 100 countries. They include consultants, academics, journalists, lawyers, and medical professionals with rich knowledge of their countries’ governance and regions, as well as the industries and issues that shape their economies.

To harness their insights, we invented Network PulseTM, a patent-pending technology that takes each client question, identifies the best set of Wonks to answer it, and gets those answers to the client within minutes or hours.

With 2019 fast approaching, we used a series of Network Pulses to probe our wonk community about issues they will be watching in the coming year. We asked them for:

Top global issues to watch.

Top issues in their region or country.

Developments underemphasized on business leaders’ and investors’ radars.

While political and business risks are front-of-mind as 2018 comes to a close, we were particularly interested in the opportunities and upside risks the Wonks foresee.

The report then goes on to explore three system-impacting dynamics: US-China trade struggle, a growth slowdown whose center of gravity lies in Beijing, and what is described as "interlocking domestic risks" - a rather benign euphemism for the West experiencing a political nervous breakdown in the forms of nationalism, nativism, protectionism, and xenophobia. The rest of the report examine regional dynamics in the fashion of a survey.

For an early-stage start-up rapidly approaching mid-stage, it's a fine document. But I'll expect far better next year as analytic processes and products continue to emerge and mature. As I have noted before, GlobalWonks seems like the most practical iteration yet of a model that I myself have worked on - over the past three decades - in a variety of public and private-sector ventures. Instead of trying to boil the ocean every day, GlobalWonks allows clients to drill down - through its network - to ground-floor expertise.

In many ways, GlobalWonks is the analytic version of the Globally Integrated Enterprise that progressively replaces the old MultiNational Corporation model. The MNC concentrated its creativity in the home nation, mostly producing there and distributing globally. But that eventually came off to locals as predatory (think back to America's defensive reaction to the Japanese car invasion of the 1970s and 1980s). Toyota and Honda fixed that by transforming themselves into GIEs that locally sourced, R&D'd, manufactured, and sold - but on a global scale. They made themselves corporate citizens of both the world and every major market they targeted.

GlobalWonks approximates that transformation in the domain of consulting. Has it mastered it yet? No, but it's moving with real speed and ambition. And let's remember, Honda and Toyota didn't complete that journey overnight.

So while GlobalWonks is its own experiment, by my measure, it moves in the right direction with the correct ambitions: deep global networking harnessed for very granular analytic products delivered at high speed and low cost. It's not only WYSIWYG in the company's make-up, you also get what you pay for in the most immediate and transactional sense. In short, you - as a client - aren't left wondering what exactly did we just get for our money?

To download your own copy of the report, click here.

Feedback naturally welcomed, and feel free to funnel it through me.

Friday, February 5, 2016 at 11:08AM

Friday, February 5, 2016 at 11:08AM  AFTER AMERICA RODE A TIDAL WAVE OF ECONOMIC INTEGRATION AND EXPANSION FOLLOWING ITS CIVIL WAR (MOVING RAPIDLY FROM A SECTIONAL ECONOMY TO A TRULY CONTINENTAL ONE), A FRIGHTENING STRETCH OF BOOMS AND BUSTS IGNITED A LENGTHY PROGRESSIVE ERA (BREAKING FOR THE ROARIN' TWENTIES) WHEN POLITICAL ACTORS FROM BOTH PARTIES SOUGHT SYSTEMIC REFORMS - LEST THE COUNTRY SUCCUMB TO THE SORT OF RADICALISM LOOMING IN EUROPE (SEE FALLOUT OF WWI, CAUSES OF WWII). It was a frightening journey in many ways, with worried leaders concerned that the very nature of American democracy was at stake. But this is the usual price to be paid in return for a radical and lengthy expansion of economic activity, and it's one the world faces today after that quarter-century-plus boom that ended in 2008-09 and left the global economy with a bad hangover of toxic debt that is still largely to be processed.

AFTER AMERICA RODE A TIDAL WAVE OF ECONOMIC INTEGRATION AND EXPANSION FOLLOWING ITS CIVIL WAR (MOVING RAPIDLY FROM A SECTIONAL ECONOMY TO A TRULY CONTINENTAL ONE), A FRIGHTENING STRETCH OF BOOMS AND BUSTS IGNITED A LENGTHY PROGRESSIVE ERA (BREAKING FOR THE ROARIN' TWENTIES) WHEN POLITICAL ACTORS FROM BOTH PARTIES SOUGHT SYSTEMIC REFORMS - LEST THE COUNTRY SUCCUMB TO THE SORT OF RADICALISM LOOMING IN EUROPE (SEE FALLOUT OF WWI, CAUSES OF WWII). It was a frightening journey in many ways, with worried leaders concerned that the very nature of American democracy was at stake. But this is the usual price to be paid in return for a radical and lengthy expansion of economic activity, and it's one the world faces today after that quarter-century-plus boom that ended in 2008-09 and left the global economy with a bad hangover of toxic debt that is still largely to be processed.Per a solid NYT story of late:

Beneath the surface of the global financial system lurks a multitrillion-dollar problem that could sap the strength of large economies for years to come.

The problem is the giant, stagnant pool of loans that companies and people around the world are struggling to pay back. Bad debts have been a drag on economic activity ever since the financial crisis of 2008, but in recent months, the threat posed by an overhang of bad loans appears to be rising. China is the biggest source of worry. Some analysts estimate that China’s troubled credit could exceed $5 trillion, a staggering number that is equivalent to half the size of the country’s annual economic output ...

But it’s not just China. Wherever governments and central banks unleashed aggressive stimulus policies in recent years, a toxic debt hangover has followed. In the United States, it took many months for mortgage defaults to fall after the most recent housing bust — and energy companies are struggling to pay off the cheap money that they borrowed to pile into the shale boom ...

In theory, it makes sense for banks to swiftly recognize the losses embedded in bad loans — and then make up for those losses by raising fresh capital. The cleaned-up banks are more likely to start lending again — and thus play their part in fueling the recovery.

But in reality, this approach can be difficult to carry out. Recognizing losses on bad loans can mean pushing corporate borrowers into bankruptcy and households into foreclosure. Such disruption can send a chill through the economy, require unpopular taxpayer bailouts and have painful social consequences. And in some cases, the banks might find it extremely difficult to raise fresh capital in the markets.

Sounds like recent American history, yes? It's 2016 but there's still palpable anger over the Wall Street bailouts and far too many Americans still struggle with unsustainable credit debt. But, by way of comparison, the U.S. dealt with the financial crisis with genuine speed.

Yes, op-ed columnists are still arguing about the bailouts and the stimulus spending (the latter being somewhat irrelevant to curing a financial crisis), with plenty still arguing for more spending (like Paul Krugman). And we most certainly have endured a strange era of name-calling: remember when President Obama was a "socialist" in the eyes of his enemies?

But now we have a serious Democratic candidate for president in Bernie Sanders who embraces the Social-Democrat moniker, and he gets enough traction with that to force Secretary Clinton into making her own claims at the progressive label. On the other side, Republican candidates are struggling with the terms but reaching for the same sense of popular desperation - the feeling that the middle class has been under assault for years now. It's just that too many candidates in the GOP are having trouble separating that valid concern from the sort of anti-immigrant sentiment that is historically attached to such fears.

Still, all this shouting and posturing and name-calling reflects something positive: compared to the rest of the world, America was more confident in processing its toxic debt overhang. Plenty of work to be done, but the job is engaged. What the NYT article laments is the lack of similar progress elsewhere, and, in my mind, that progress reflects a political lack of confidence in the systems afflicted - one that prevents them from moving more aggressively because they fear the very fabric of their governments' political legitimacy might tear.

China is the scariest example in this regard. Per the chart above, we see just how integrated and important the Middle Kingdom has become with regard to the global economy's functioning. Scarier still is the damaging precedent set by neighboring Japan:

Japan, economists say, waited far too long after its credit boom of the 1980s to force its banks to recognize huge losses — and the economy suffered for years after as a result.

But Japan stalled out during the go-go nineties, so it could only do so much damage on a global scale. But, as the world went on a growth tear over the next decade and a half, the stakes today are so much larger - as is the poster-child for not facing the truth with enough alacrity - again, China.

Headline figures for bad loans in China most likely do not capture the size of the problem, analysts say. In her analysis, [one prominent local observer] estimates that at the end of 2016, as much as 22 percent of the Chinese financial system’s loans and assets will be “nonperforming,” a banking industry term used to describe when a borrower has fallen behind on payments or is stressed in ways that make full repayment unlikely. In dollar terms, that works out to $6.6 trillion of troubled loans and assets.

None of that was truly unexpected. You spend your way out of a financial crisis and you're simply delaying your day of reckoning - an essentially political process of regrading the economic landscape like the two Roosevelts (Theodore and Franklin) once did for the U.S. under similarly tumultuous circumstances (may I suggest Ken Burns' 14-hour documentary "The Roosevelts" on Netflix).

It's just that no one can spot that sort of leadership in China right now. We've seen some experts compare Chinese president Xi Jinxing to T.R. in terms of foreign policy machismo (largely on display only in the South China Sea), and Xi has definitely earned his corruption-busting stripes for his lengthy recent domestic campaign. But processing China's frightening large pool of toxic debt?

The looming question for the global economy, however, is how China might deal with a vast pool of bad debts.

After a previous credit boom in the 1990s, the Chinese government provided financial support to help clean up the country’s banks. But the cost of similar interventions today could be dauntingly high given the size of the latest credit boom. And more immediately, rising bad debts could crimp lending to strong companies, undermining economic growth in the process.

“My sense is that the Chinese policy makers seem like a deer in the headlights,” Mr. Balding said. “They really don’t know what to do.”

And that, my friends, is the biggest uncertainty right now in the global system. ISIS, for all its ferocity and atrocities, does not compare. Sanders/Clinton v Trump/Cruz/Rubio does not compare. The Brexit/Grexit/Whoxit? dynamic in the EU does not compare.

And this is where multiparty, pluralistic democracies rule - when they choose to. They can "throw the bums out." Heck, they're required to in the U.S. after 8 years - maximum (our presidential administration). Being able to apply the "clean slate" is a huge act of political resiliency, one that China, with its single-party state, is presently unable to employ.

And that is worrisome for the entire global economy as it continues to process the toxic overhang from that great global economic expansion that we all now remember so fondly.

China,

China,  US,

US,  finance,

finance,  global economy,

global economy,  resilience | in

resilience | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Tuesday, January 19, 2016 at 3:44PM

Tuesday, January 19, 2016 at 3:44PM  AP photo, used in WAPO citationIT MAY SEEM AN OBVIOUS - ALMOST TRITE - OBSERVATION AT THIS POINT IN HISTORY, BUT YOU WOULDN'T KNOW IT FROM THE WAY WASHINGTON, THE PENTAGON, AND OUR CURRENT SLATE OF PRESIDENTIAL CANDIDATES SPEAK ABOUT CHINA. That fundamental disconnect is somewhat scary to, as well as dangerous for, the rest of the world. And no, I don't note that as some subtle plea for better and less contentious relations with China, because it will always take two to tango. I do, however, note it as a continuing negative trend when it comes to these two nations' co-management of global economic stability.

AP photo, used in WAPO citationIT MAY SEEM AN OBVIOUS - ALMOST TRITE - OBSERVATION AT THIS POINT IN HISTORY, BUT YOU WOULDN'T KNOW IT FROM THE WAY WASHINGTON, THE PENTAGON, AND OUR CURRENT SLATE OF PRESIDENTIAL CANDIDATES SPEAK ABOUT CHINA. That fundamental disconnect is somewhat scary to, as well as dangerous for, the rest of the world. And no, I don't note that as some subtle plea for better and less contentious relations with China, because it will always take two to tango. I do, however, note it as a continuing negative trend when it comes to these two nations' co-management of global economic stability.A couple of Reuters' pieces today remind us of just how important China has become to global markets and their expectations. First, any new economic forecast figures from China are momentous enough to shift IMF calculations for future global economic growth:

The International Monetary Fund cut its global growth forecasts for the third time in less than a year on Tuesday, as new figures from Beijing showed that the Chinese economy grew at its slowest rate in a quarter of a century in 2015.

To back its forecasts, the IMF cited a sharp slowdown in China trade and weak commodity prices that are hammering Brazil and other emerging markets.

The Fund forecast that the world economy would grow at 3.4 percent in 2016 and 3.6 percent in 2017, both years down 0.2 percentage point from the previous estimates made last October. It said policymakers should consider ways to bolster short-term demand. [emphasis mine]

Unsurprisingly, the Reuters pieces notes that "concerns about Beijing's grip on economic policy have shot to the top of global investors' risk list for 2016 after falls in its stock markets and the yuan stoked worries that the economy may be rapidly deteriorating." So, it's not just a matter of China's economic health but what Beijing intends to do about it. Frankly, until very recently in history, the only countries that registers at that level of impact has been the United States, Japan, and the EU as a collective. But come back with me to review the stimulus spending that unfolded in response to the global financial distress of 2008-09, and the numbers there previewed just how central China had become:

In other words, when push came to shove and big economies needed to pony up the money to shore up global economic demand, China outperformed the EU and Japan put together by making an effort bested only by the US.

This is why, per the second Reuters citation, just as many eyes are on Beijing as Washington right now:

Global equity markets on Tuesday snapped back from a rout at the start of the year after data showing weak economic growth in China prompted speculation Beijing would boost stimulus efforts, but a renewed drop in U.S. oil prices raised a cautionary flag.

China's rise from being a detached corner of the global economy - just four decades ago - to its status as second-most important pillar is akin to America's stunning, turn-of-the-20th-century rise to global prominence following our Civil War. And yes, the US of that era scared a lot of the world with its ambition, arrogance, and self-centeredness - just like China does today.

But we lucked out and picked up a mentor in the British, who, over time, had no choice but to encourage our rise as central to their own continued prosperity, security, and even national survival. The truth is, with all the world has on its plate right now with climate change, terrorism, technological leaps, and so on, the US is as likely to become as entirely co-dependent on China's national resilience in the 21st century as the British once became on US resilience in the 20th century.

Do I see any such recognition among our political and military leaders on this score? No I do not. And that worries me.

Do I see it across this country? It depends on your age, as in, the older you are, the more you tend to fear China. You also tend to fear China more if you are located in the interior and east of the US versus the Pacific-minded US West.

But I do see a different mindset among the Millennials, which, by all polling, appear to view China more as an ally in co-managing this world than an antagonist. And, based on my time in China, I spot enough of the same among China's youth to suggest that this co-dependent relationship will ultimate work out just fine.

What worries me most is getting from now to then.

The US spent decades after WWII working to spread and sustain an international liberal trade order that we now dub "globalization." We were enormously successful in this endeavor, triggering the greatest reduction in global poverty and the greatest upsurge in global development that the world has ever seen. But, in doing so, we created a host of economic "challengers" whom we must eventually come to accept as co-enablers of our own national resilience, as well as the resilience of the planet.

The hardest part for Americans seems to be this supposition that, if a foreign civilization joins this global trade order (as China has) and becomes highly capitalistic (as China has), it must rather rapidly become highly American as well (raucously pluralistic in politics). However, to our continuing bafflement, almost half a century after Nixon went to China, the Chinese are still Chinese.

I know, right? How dare they!

And that seems to upset a great deal of Americans to no end - but particularly older Americans, many of whom now seem to see, in China, a monster of our/globalization's making - a Frankenstein who cannot possibly be tamed (much less told what to do).

As suggested earlier, I expect generational change in both countries to solve this trust-divide that currently keeps the world's two greatest economies (and militaries) from realizing the full extent of their co-dependencies. For now, it's important enough for players - and citizens - on both sides to realize just how much we collectively rely on one another's national capacities for resilience in face of common threats and challenges, AND to remember just how different this relationship is from the one we once endured with the Soviet Union - an empire that was bound to our national survival in terms of its nuclear weaponry but not to our economic resilience to any appreciable degree.

And that is what makes China entirely different.

China,

China,  Russia,

Russia,  US,

US,  global economy,

global economy,  resilience | in

resilience | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Tuesday, December 1, 2015 at 12:17PM

Tuesday, December 1, 2015 at 12:17PM

YESTERDAY THE INTERNATIONAL MONETARY FUND (IMF) ANNOUNCED that China's renminbi would become its fifth designated reserve currency, joining the US dollar, EU euro, British pound, and Japanese yen. The move comes in response to a several-year campaign by Beijing to have its currency thus credentialized. For now, central banks around the world hold only about 1% of their reserves in RMB, but Beijing has created an outsized latent reserve currency presence (another 5%) by concluding numerous significant currency swap deals with major trading partners. The latter scheme was apparently enough for the IMF to finally move on China's strong desire.

READ THE ENTIRE POST AT:

Wednesday, May 13, 2015 at 4:14AM

Wednesday, May 13, 2015 at 4:14AM Maylay Mail Online by Zurairi AR, 9 March 2015

PUTRPUTRAJAYA, March 9 — Tun Dr Mahathir Mohamad claimed today that the controversial Trans-Pacific Partnership Agreement (TPPA) is a “New World Order” (NWO) ploy that would lead to the world’s most powerful countries dominating the global economy.

The former prime minister also claimed that the TPPA, like many other free trade agreements, is a way for the NWO to establish a “one world government” through globalisation, as no other approach appears to be viable any longer.

“It’s not a partnership. All the countries which participate will be subjected to more rules than they ever had before,” Dr Mahathir told the International Conference on NWO organised by the Perdana Global Peace Foundation (PGPF).

“The TPPA is not about free trade, it’s about trade subjected to all kinds of laws and regulations, exposing countries to be sued by the international courts.”

The staunch TPPA critic also claimed that the countries that remain “recalcitrant” or refuse to conform to the trade agreement will be threatened by economic sanctions under this NWO.

Among others, Dr Mahathir listed down Iran and Russia as examples.

The conference accused today the existence of an NWO, where an allegedly secret group of elites are conspiring to rule the world via globalisation and a world government, replacing sovereign nation-states.

Dr Mahathir’s argument was however countered by Washington-based security consultant Thomas PM Barnett, who claimed that the US has put in place measures that seem to penalise itself more than other economies.

“Globalisation comes with rules. US pioneered the creation of the International Monetary Fund, the World Bank, the general agreement on trade and tariffs that became the WTO,” Barnett said, referring to the World Trade Organisation.

“Well, the country most sued, since the WTO court was created, was the US. The country that has lost more suits than anybody else in the world in the WTO court, has been the US,” he added.

Barnett, who is also an author and public speaker, also claimed that the US has even allowed the emergence of rival trading blocs such as the BRICs -- comprising Brazil, Russia, India and China – and MINT – made up of Mexico, Indonesia, Nigeria, and Turkey, instead of stifling them.

- See more at: http://www.themalaymailonline.com/malaysia/article/tppa-a-new-world-order-conspiracy-to-regulate-trade-dr-m-warns#sthash.8DQIZlCg.dpuf

Full article at http://www.themalaymailonline.com/malaysia/article/tppa-a-new-world-order-conspiracy-to-regulate-trade-dr-m-warns

global economy | in

global economy | in  Tom in the media,

Tom in the media,  Tom's speaking engagments |

Tom's speaking engagments |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Wednesday, January 30, 2013 at 10:24AM

Wednesday, January 30, 2013 at 10:24AM

Subject is, do robots kill more jobs than they create?

We've approached this question many times in various Wikistrat sims, and they are many thoughts on the subject.

In a macro sense, the nightmare scenario is silly: no society is going to job-destroy its way to rule by robots. The amateur economist in me believes life just migrates into new areas, so there are plenty of jobs creating robots and economic activity moves on to new challenges/spheres/what have you.

But in the near-term sense, people's perceptions of the disruptive churn (sure to happen) matter a whole lot.

So this NYT report by the always smart John Markoff on a recent robotic industry conference that sought to allay some of these fears (robots everywhere!).

Some counter-arguments:

Hmm. Not exactly decisive, but you get the idea. Nobody wants to own the world's most manpower-intensive manufacturing sector - except maybe Bangladesh. So there's no way to go except onward and upward, as my Dad used to say. Manufacturing, if highly productive, still wins and creates wider wins in your economy.

But yeah, you still have to beat the next guy - and his robot.

Tuesday, October 30, 2012 at 8:38AM

Tuesday, October 30, 2012 at 8:38AM

Interesting FT column by Satyajit Das.

Two important factoids:

There was a time for both countries (US in 1950s and China at end of Cold War) where $1-2 of debt would do.

Then an almost Marxian critique:

Debt became a mechanism for hiding disparities in the wealth distribution within many societies. Increased credit availabiliby allowed lower income groups to borrow and spend, encouraging housing booms, in order to deal with the underlying problem of stagnant real incomes.

A bit skewed in its causality. Credit has always been the mainstay of growth in a capitalist society. Reducing its function to "hiding disparities" is a very narrow view.

The stagnant real incomes problem is hardly universal in this current era of globalization. It is felt primarily in the West, where jobs easily cordoned off from global competition now suffer it greatly. This is the "cost" of letting so much of the world into the global party called globalization. We can decry this, but the cost of our privilieged standard of living in the past was the vast exploitation/disconnection of much of the world, or the have/have-not divide that Europe begat in its previous extension of colonial-globalization.

Is it worth to me to live in a far more just world to suffer this income stagnation?

As a Christian who believes I'm not just here to hoard and tell others to go f#$K themselves, yes, it is worth it.

Did we get addicted to cheap debt in the vast transaction strategy we ran with the world so as to spread the international liberal trade order already deeply embedded in these United States (this multinational economic union)?

We sure did.

Will we eventually run out of new sources of cheap labor in the global economy?

Absolutely. Within my life. But that will be a better problem than today's.

So where do find growth in the future?

The rise of the global middle class - the best thing to ever happen on this planet - will force magnificent resource utilization revolutions. This will dovetail with new environmental challenges (or the exacerbation of old ones). Again, these will constitute our best problems yet.

But massive adjustments must be made to protect the vulnerable amidst globalization's continued rapid expansion. And great investments must be made to bootstrap our national economy into a more realistically competitive shape for the struggles to come.

And that's why higher taxes are coming for the rich in this world. We enter a length redistributionist phase so as to avoid political tumult. It is capitalism's great genius - in combination with democracy - to recognize these moments in history and to address them head-on. Once the oncoming global progressive era works its necessary magic (and no, those ideas and leaders are - by and large - yet to emerge), such a burden for the rich will be less necessary.

But to pretend that tax cuts are the answer now, amidst the populist anger spreading across this planet and in particular this country, is to stay pointlessly dogmatic. There is no one economic theory that rules throughout time. There are seasons for each.

A foolish consistency is the hobgoblin of little minds.

- Ralph Waldo Emerson

Thursday, October 4, 2012 at 9:07AM

Thursday, October 4, 2012 at 9:07AM

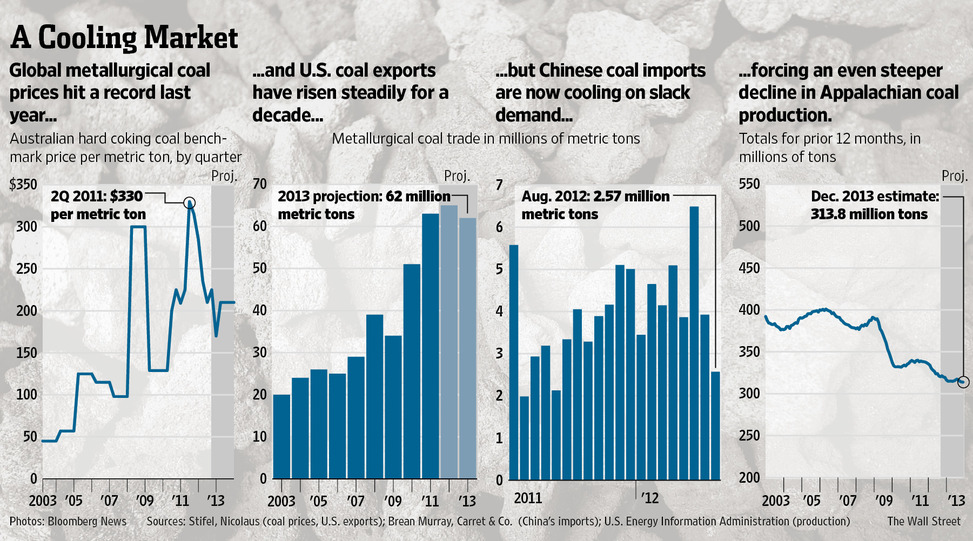

From a WSJ front-page story.

The U.S. coal industry wants you to believe its slowdown is caused by Washington's "meddlesome regulations," but as I noted earlier, the big killer is the cheap price of U.S. natural gas, which is displacing domestic use of coal for electricity generation big-time (25% down in a recent quarter).

Culprit #2 is the Chinese economic slowdown, which is really the culprit, along with Europe's problems, for the slowdown in general global economic activity.

Pretty amazing times, when you think about it. Remember when the U.S. economy was all you needed for a global expansion?

Thursday, September 27, 2012 at 11:18AM

Thursday, September 27, 2012 at 11:18AM

WSJ story noting that:

Migrant workers abroad sent more money to their families in the developing world last year than in 2010, and they are expected to transfer even more cash home this year despite the economic uncertainly gripping the globe.

You can see the divot created by the financial crash in 2008, but note how the trajectory resumes like it never even happened.

The number is staggering: $372B last year. World Bank predicts almost half a trillion will flow in 2014.

Key bit:

Remittances remain a key source of hard currency for developing countries, often outstripping foreign direct investment and foreign aid.

It can "immunize" your country from downturns, so sayeth a new WB book on the subject.

Both intra- and inter-regional flows are rising in same manner, with key technological enabler being how cheap it is for ordinary people to wire money.

One of the biggest players in this realm at about 1/7th of global market? Western Union.

How's that for a frontier metaphor? Back then it was all about telegraphs. Now it's all about remittances.

Thursday, August 9, 2012 at 10:41AM

Thursday, August 9, 2012 at 10:41AM  Economist story: "for the first time since 1998 more money leaves China than enters it."

Economist story: "for the first time since 1998 more money leaves China than enters it."

On the surface, you say, "balanced trade!" when what you should really say is "balanced investment!" But even there you'd be missing the subtext, so sayeth The Economist:

MAINLAND China can now boast over 1m wealthy citizens (qianwan fuweng) each with over 10m yuan ($1.6m), says the latest edition of the “Hurun Report”, which keeps track of China’s capitalist high-roaders. But the mainland seems to be having trouble keeping them. According to the report, published on July 31st, more than 16% of China’s rich have already emigrated, or handed in immigration papers for another country, while 44% intend to do so soon. Over 85% are planning to send their children abroad for their education, and one-third own assets overseas.

The affluent 1m have profited handsomely from China’s economic boom. But only 28% of those asked expressed great confidence in the prospects over the next two years, down from 54% in last year’s report.

Them's some stunning numbers: 60% of the rich plan to emmigrate and 85% are sending their kids abroad - thus perpetuating the attraction of leaving the Mainland.

Frankly, those are numbers and dynamics one associates with post-Cold War Russia or Africa of the past several decades. There is a looting quality to this circumstance, driven primarily by the sense that China is becoming a dangerous place to have wealth.

Now, we can all get jacked with the dominant populist vibe (check out the "Dark Knight Rises"), but it's a very negative sign when your rising economy's rich people don't want to stick around. For China it says, we don't trust the - now longstanding - reforms will stay in place. It also says, we want to go where our wealth translates into genuine political power (rich people are like that).

True political pluralism usually arises when the rich realize that the only way they can keep their wealth is to open up the system for a stabilizing middle class to take the reins of political power. No, they don't enjoy the process, but it beats the alternative - revolution typically from the lower classes.

This dynamic is presenting itself across much of the developing world right now: we see the rise of a truly global middle class and - big surprise - amidst all that wealth creation a super-rich emerges (happens every time), thus the richest-to-poorest delta is fantastically large. That's when you get nasty populism that, by and large, can either be deflated nicely by a long progressive period of cleaning up the system, environment, politics, etc., or can explode into something far more destructive.

Europe got that initial middle class about the same time America did, and Europe came up with two scary alternatives: Bolshevism to prevent that dastardly bourgeoisie from emerging, and fascism, which pretended to protect those "shopkeepers" from radicalized workers but really was about keeping the rich safe and everybody else wound up by freakish nationalism and militarism.

America split the difference brilliantly, plowed through a lengthy progressive era, and centered its political system - along with its economy - on a stable middle class.

We are rerunning that Western experiment now on a global scale, with the biggest democratization process to come being - obviously - China, which faces the daunting task of democratizing amidst a progressivist dynamic (like virtually everything China does, it's a combination that's unusual in its "cramming it in" ambition, but there you have it). Meanwhile, the West is coming to grips with two stunning problems: it no longer can manage a blue-collar middle class status and hasn't adjusted its educational system from its industrial era origins, and it's facing a demographic aging wave (less so the US) that forces it to revamp its industrial age pension and healthcare systems rather drastically.

The progressive age that must inevitably unfold globally so as to tame globalization's natural excesses (in this period of rapid expansion) is the most important challenge humanity faces in the next several decades. Truth be told, global warming will by and large have to await that process before being truly addressed on a systematic level (even as much progress should occur thanks to the fracking revolution and its triggering of widescale movement "down" the hydrocarbon chain).

But back to the point of the piece: China's movement toward accepting a progressive era is crucial to initiating this process on a global scale, because a China that moves down this path will be less frightening to an America that is currently using the excuse of "scary" China to delay its own internal reforms (the AirSea Battle Concept being just one telling symptom of a general political escapism).

And this is where I go back and forth in my fears and hopes for China. Whenever I'm there I meet so many in the elite who are acutely aware of all this and realize the global responsibility China's internal development represents. But then I also meet plenty who can't rise above their own fears for their own status. So no, this battle is not decisively waged in either direction, even as I take great solace in the whole Bo Xilai Affair and its diminishment of the brain-dead Red revivalism in the interior.

Interesting times ...

Thursday, July 19, 2012 at 11:57AM

Thursday, July 19, 2012 at 11:57AM  Nifty WSJ full-page report in mid-June entitled, "Beneath a war of words, money paints a different China-U.S. picture." The subject? Chinese investments in US renewable energy efforts.

Nifty WSJ full-page report in mid-June entitled, "Beneath a war of words, money paints a different China-U.S. picture." The subject? Chinese investments in US renewable energy efforts.

Just like in the case of hydraulic fracking, we see the Chinese eager to collaborate.

Naturally, as the less advanced technology economy, the Chinese are eager to go beyond collaboration into . . . ahem . . . aggressive collaboration, let's say. But let's be honest: that's the incentive for the less-technologically gifted party in any technological investment. For the more advanced party, the goal is an expanded pool of opportunity over time:

Read the headlines and you find a war of words between the U.S. and China over clean energy, with the two countries trading barbs over whether Chinese solar-panel makers are dumping their wares onto the U.S. market at prices so low they're illegal. Follow the money more broadly, however, and you see something different: clean-energy investors and executives from the two countries starting to do deals.

Chinese businesses, typically with Beijing's support, are beginning to buy stakes in U.S. clean-energy companies and projects, often with Washington cheering. The deals span technologies from cleaner ways to burn coal to cheaper ways to use renewable power.

Each side has reasons to expand this capital flow. The Americans get the Chinese money and, with it, access to China's vast market, which is far hungrier for clean-energy innovation than the U.S. The Chinese get U.S. technology to help sate their soaring energy demand, and a place to invest that looks positively low-risk compared with their home turf.

As for the fears? Money talks - no matter the language.

One reason is economic. Federal stimulus money for the energy industry is tapering off, and other federal clean-energy subsidies, many of which failed to deliver enough bang for the buck, are likely to get pared back, too. More than ever, U.S. clean-energy companies could use the help of China's investors and consumers.

Another reason is environmental. Many clean-energy technologies are getting cheaper but are still too expensive to compete against conventional fossil fuels. The only way they stand much chance of gaining real scale is if the world develops and deploys them in the most economically efficient way: across national borders. Moreover, if American clean-energy technologies aren't deployed in China, where air pollution is thick and greenhouse-gas emissions are rising, then whatever cleanup those technologies accomplish on U.S. soil won't much matter.

Thank God for the logic of businesspeople. Imagine if the Pentagon could aspire to such thinking.

China,

China,  FDI,

FDI,  US,

US,  global economy,

global economy,  technology | in

technology | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Monday, July 2, 2012 at 12:43PM

Monday, July 2, 2012 at 12:43PM  Check out this bit from today's NYT:

Check out this bit from today's NYT:

In the four years since President Obama swept into office in large part with the support of a vast army of young people, a new corps of men and women have come of voting age with views shaped largely by the recession. And unlike their counterparts in the millennial generation who showed high levels of enthusiasm for Mr. Obama at this point in 2008, the nation’s first-time voters are less enthusiastic about him, are significantly more likely to identify as conservative and cite a growing lack of faith in government in general, according to interviews, experts and recent polls.

Polls show that Americans under 30 are still inclined to support Mr. Obama by a wide margin. But the president may face a particular challenge among voters ages 18 to 24. In that group, his lead over Mitt Romney — 12 points — is about half of what it is among 25- to 29-year-olds, according to an online survey this spring by the Harvard Institute of Politics. And among whites in the younger group, Mr. Obama’s lead vanishes altogether.

Among all 18- to 29-year-olds, the poll found a high level of undecided voters; 30 percent indicated that they had not yet made up their mind. And turnout among this group is expected to be significantly lower than for older voters.

“The concern for Obama, and the opportunity for Romney, is in the 18- to 24-year-olds who don’t have the historical or direct connection to the campaign or the movement of four years ago,” said John Della Volpe, director of polling at the Harvard Institute of Politics. “We’re also seeing that these younger members of this generation are beginning to show some more conservative traits. It doesn’t mean they are Republican. It means Republicans have an opportunity.”

There is the strong evidence that a minority-white/majority non-white America favors the Dems long term, but history also says that an extended "tough time" favors the GOP, especially when you remember that the average voters behaves - over the course of his or her life - much like a car-buyer, meaning your first "purchase" typically creates a brand loyalty that is highly consistent over your life (meaning, it has an imprinting function that is profound). Simple example: If the first car you buy is a Ford, you will - on average - buy more Fords over the rest of your life than any other car - hands down. Same is true in voting for president.

Point being, while the demographic shift will still favor Dems (as currently defined) against Republicans (as currently configured), this long recession will have its own profound imprinting impact as well. I see it in kids through the prism of my 20-year-old daughter (now in college). They face a hostile labor market not unlike the one my generation faced in the early 1980s. Between that point and 2008, college-age cohorts faced a fantastically (in historical terms) consistent positive labor environment. But my impression is that those days are gone - probably for good given the competitive landscape now created by a maturing globalization.

So, again, you have your demographic trends and you have your economic realities trend. Both are profound influencers. I'm just saying nothing is carved in stone in terms of long-run trends, especially as I expect both parties to be significantly reshaped by these dueling trends over the next decade or so.

Still, I see little in any of these reports that convinces me Obama will fall in the Fall.

US,

US,  demographics,

demographics,  economy,

economy,  elections,

elections,  global economy,

global economy,  globalization | in

globalization | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Saturday, June 30, 2012 at 1:01PM

Saturday, June 30, 2012 at 1:01PM From the Financial Times and very interesting.

Key fact: goods and services trade only 1/5th of US economy in 1980. Now it's one-third.

Other key data:

We also have the highest percentage of foreign born citizens since 1920.

Monday, June 11, 2012 at 11:28AM

Monday, June 11, 2012 at 11:28AM  Wang v. Bo - preview of coming clashes!Got it via a friend who read Krugman's post on this post. Here's the Krugman's site, and here's the original post.

Wang v. Bo - preview of coming clashes!Got it via a friend who read Krugman's post on this post. Here's the Krugman's site, and here's the original post.

Hempton's description is correct, by everything I know. He's just a bit much on the name calling ("China is a kleptocracy of a scale never seen before in human history.") Krugman reads the post and sees, per his usual pessimism, a system bound to implode.

What Hempton describes is a form of capital expropriation of the Asian variety. It is different in style than what happened in the West (super-low wages) because it focuses on abusing the average Chinese citizens' savings to prop up state-run enterprises while allowing the elite to siphon off extraordinary profits. But understand that Japan and South Korea did much the same, so yeah, the scale is magnificent but the dynamic is familar.

The system is right for China in terms of preventing instability and allowing for an overall rise in GDP per capita that generates a massive middle class (in sheer numbers, less so as a percentage of total population). It'll be right until the people can't stand it anymore (populist anger) or the global economy can't stand it anymore (the export-driven growth and general mercantilism) or the national economy can't stand it anymore (the heavy reliance on public investment).

Now, Hempton's take is all righteousness to point of sounding like a Marxist, which is correct enough and ironic enough, but, you know, Marx was right on a lot of things. He just couldn't imagine a political system smart enough and flexible enough to bend at the point of near-breaking. In the West, he didn't believe democracies could pull it off - except they did.

Now, we Westerners can't image single-party states in the East managing the same. Except Japan did actually move off the model - to a certain extent. South Korea has done it much better. China approaches the historical moment when it must happen; when it must turn into a system ruled by the middle.

Will it become a recognizable democracy? So many experts will tell you that cannot happen due to Asian civilization. I personally find that bullshit and always have. It won't resemble Western democracy but it will define - just like Japan and South Korea have - Eastern democracy (and yes, that concept makes some experts' heads burst into flames once they scream, "INCONCEIVABLE!").

Here again, I think Marx is right in saying that capitalism is so revolutionary that it remakes societies. It just does at the pace of generational change - duh!

China's system works in expanding capitalism throughout China and creating tremendous (and real) growth and in networking China with the global economy. It works just like America's system of global governance through the absorption of export-driven growth and debt-financing-as-a-reserve-currency and providing (with all that cheap money) military Leviathan services worked for expanding globalization for about 25 years in the long expansion from the early 1980s through the late 2000s. It works until it works itself into an imbalance that requires correction and new rules and new policies, etc. It works until it succeeds too much and thus stops working - simple as that.

What always happens when a system like either of those reaches its apogee of success and no more success can be had is that the critics come out in droves and go ape-shit in their condemnations. Suddenly, not only is the created imbalance bad, but the entire system is evil and all that came through it is viewed as a complete fraud.

This is way over-the-top analysis and Hempton's piece is chock full of it. But it's this kind of Cassandra crying that signals you're reaching the endpoint and system-failure-triggering-revolutionary-solutions is nearing.

So yeah, an accurate description, and yeah, way over-the-top in its gloom-and-doomism.

Why have the Chinese people allowed this system to unfold and expand and reach such imbalance? Because it's delivered the country and a great deal of them a far improved life - simple as that.

Why will the Chinese people progressively rebel against the system now and in the future? Because it's reached the point where it stops working as well as it did in the past - in large part because China hits the same shift point between extensive and intensive growth that all risers hit - again, simple as that.

Yes, we can call it all sorts of names and point fingers, and pull our hair, and predict all manner of doom.

But you know what? China ain't going anywhere. The system will adapt.

No, it won't be pretty, but the Asian version of capitalism adapts just like the Western version did. Eventually the rich find they have enough and want to protect their wealth through enhanced social stability - even more equality - if that's what it takes. Eventually, the rank-and-file see that they've eaten enough bitterness on behalf of China so that they deserve a better cut.

If China hits the same roughly-five-decades-mark on single-party rule and then spasms toward democracy, like so many other Asian nations have in their individual "rises," then that democratizing point probably arrives in the 2020s (but between now and then, expect tons of apres moi, le deluge handwringing that will mentally prep the Chinese people for the coming change). I am convinced China cannot make it past that point in history and wealth creation (by 2030, a per capita GDP of about $20,000) without going full democratic (always with some Asian/Chinese twists, mais oui).

But, as we know, China is doing everything so fast in comparison to Japan and South Korea and other predecessors. But it's also far larger (which is why EVERYTHING in China is the "biggest in human history" - puhleaze!), meaning we can't forget the extensive growth still to come in the interior provinces, where well over a half-billion poor people live.

China's rich coast must integrate its still-impoverished/poorly developed interior just like the rich-and-rising American East integrated its Wild West from 1865 to about 1900. Those were wild and crazy years, full of booms and busts and robber barons galore. But that mounting angry populism eventually segued into a progressive era of tremendous progress, one that cemented the middle class as the republic's political center.

To me, the most fascinating question out there (besides the Fracking Revolution in energy) is, How fast does China's democratization process arrive? China still has to make that interior growth happen, but, because it lacks true democracy, it's got this restive coast. Already, you see this dichotomy reflected in the Party between the coastal, cosmo "princelings" and the far-more-red interior hard-core types more rooted in the Party's past. You also saw it in the dramatic showdown between Chongqing's Bo Xilai (with his Maoist revival) and Guangdong's Wang Yang. This is classic red state-v-blue state stuff!

So yeah, the big political fights (and accompanying democratization) are coming. They'll just unfold within the Confucian mindset of the system, which will actually help a great deal in keeping this thing from exploding.

So yeah, China is deep into that journey of transformation that we've seen so many predecessing systems experience as "punishment" for their successful rises within capitalism. That's why, in my mind, there's no question that between now and 2030, all the changes desired by the West and many Chinese will come to pass - albeit in a manner that is particularly Chinese. So no, I do see the power of culture and civilization in the "how" part; I just don't think it prevents or obviates the "what" part.

So read Hempton's piece. Read Krugman's blog. Just understand that none of this is all that unprecedented. It's just the latest chapter in capitalism's expansion. Yes, it's a crucial one alright. You add China to the mix and you go from a "global economy" to globalization - pure and simple. But China won't be the last story in this epic cycle.

So don't wear yourselves out on fear and hyperbole - as "SHOCKING!" and entertaining as these "discoveries" are.

China,

China,  US,

US,  development,

development,  global economy | in

global economy | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Saturday, June 9, 2012 at 10:39AM

Saturday, June 9, 2012 at 10:39AM  Friday, June 8, 2012 at 10:26AM

Friday, June 8, 2012 at 10:26AM

From the Economist.

In a nutshell, it ain't their growing domestic consumption and it isn't their current account surplus (exporting prowess - see below), it's the amount of public investment. And as the lower right (above) chart shows, China is revving that particular supply-side motor a lot higher than either Japan or South Korea did.

All of this is to say: nothing miraculous here. And no endless linear rocket upward either.

All of this is to say: nothing miraculous here. And no endless linear rocket upward either.

Tuesday, May 29, 2012 at 11:34AM

Tuesday, May 29, 2012 at 11:34AM

Nice Washington Post piece on Saturday about how the “center of gravity” in global oil exploration and production is shifting to the Western hemisphere. No, the bulk of global conventional oil reserves still sits in the Persian Gulf, but the larger point is worth exploring: we no longer project global futures where East and West logically fight over Middle East energy reserves. Those expected long-term dynamics are collapsing right now before our eyes.

Read the entire post at Time's Battleland blog.

Monday, May 21, 2012 at 8:58AM

Monday, May 21, 2012 at 8:58AM This NYT story today really jumped out at me, and the Chinese just bought, in a signature Foreign Direct Investment move, the second-biggest movie chain in the US:

The Wanda Group, a Chinese conglomerate with extensive interests in the entertainment business, has agreed to acquire AMC Entertainment, North America’s second-largest movie theater owner, in a deal that is valued at $2.6 billion, including roughly $2 billion in assumed debt, the companies said Sunday.

David Gray/Reuters

Gerardo I. Lopez, AMC’s chief executive, left, exchanged documents with Zhang Lin, vice president of the Wanda Group, during a ceremony in Beijing on Monday.

The acquisition creates the world’s largest theater group, the companies said. It also represents a significant expansion of Chinese influence in the American film industry. The industry has been looking to China for a vast new reservoir of ticket buyers for Hollywood movies, while joining Chinese investors to produce films like the planned “Iron Man 3” and teaming up to build studio facilities and a new Disney theme park in China.

The usual motives apply: Chinese firm looking for know-how in an industry that's booming across China but isn't being as monetized as it could be - by Western standards. For the US company, a crucial sub-plot emerges a few paras down the story:

In addition to the $2.6 billion value assigned to AMC’s debt and equity in the deal, Wanda is expected to invest $500 million for what the companies called “strategic and operating initiatives.” Mr. Wang said that the money would generally be used for renovation and other needs, but that specifics were up to Mr. Lopez and his team. Mr. Lopez said there was no plan in place for the money. But, he said, it might be used to retire debt, acquire new theaters or fix up old ones.

To me, this is a very positive development, and it's one we're going to read about countless times over the next decade. And yes, it will look and feel like Japanese money "buying up everything!" across America in the late 1980s/early 1990s.

But, of course, America has "suffered" these invading waves of FDI throughout our long history as a multinational economic union. Chinese money will be just as good and useful as those of the other countries that preceeded it, and the further intertwinning of our economies will mitigate the craziness out of the Beltway crowd as they pine for a "near peer" competitor to justify the dropping floor of the defense budget.

You know, the Chinese were going to be the featured villain in the remake of "Red Dawn," but then Hollywood realized they'd be shutting themselves out of the Chinese box office, so they subbed in the North Koreans, which - of course - makes the film a complete and utter fantasy. But it just goes to show you what all this financial connectivity leads too - cooler heads prevailing everywhere save among those fiercely dedicated fear-mongers in DC.

China,

China,  FDI,

FDI,  US,

US,  global economy,

global economy,  media | in

media | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Saturday, May 19, 2012 at 9:34AM

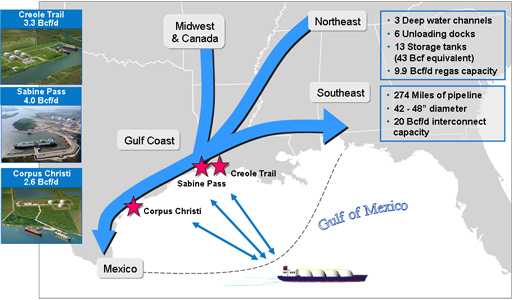

Saturday, May 19, 2012 at 9:34AM Nice FT story on what Shell is saying about natural gas in the US. Current Henry Hub price has been hanging around $2.25-2.55, which is about 3-4 times cheaper than Europe MMBTU (millions British thermal units) and bizarrely cheaper than most Asian countries are being quoted right now (more like $14-15 and moving north for the summer to almost $20 - by some predictions).

Think about that for just a second. Natural gas in the US at something like 1/8 the price in Asia. How long do you think that lasts? Why should it?

To me, that's a huge LNG (liquid natural gas) market waiting to be captured by US producers. Selling LNG ain't like moving 100,000 metric tons of diesel or jet fuel or 2 million barrels of crude in one large tanker. Those transactions are the equivalent of one-night stands and leave your money on the dresser. Selling LNG is more like getting married: the buyer has to have a relationship with a regasification terminal nearby. There must be pipes that connect the end-user to that LNG terminal (only so many in the world, but plenty being built). If no regasification terminal, then buyer needs to rent himself a regas ship ($50m a year), park it somewhere, and then connect that by pipes to the end-user. All very complex.

Of course, the seller must have liquefaction facilities at ports, with pipelines connecting fields.

America is piped up like crazy and adding more pipe all the time. We're just getting our first for-export liquefaction facility set up in Louisiana by Cheniere, which is leading the effort here to gear up for export.

All very exciting stuff, as we could be exporting - within a few years - upwards of 1/4 of our production. Then you factor in all the coal displaced in electricity generation, and we can be exporting that high-quality stuff to Asia along with the LNG - a win-win on trade balance and energy security.

Back to the FT piece: the currently depressed US prices are just too low, reflecting that we're running out of storage after a mild winter and a continued production boom. Shell's prediction? US NG prices will double by 2015. Expect the petrochem industries to hawk that fear like crazy, but in truth, it's a reasonable rise to just $4-6 MMBTU.

[Shell, BTW, has done a lot of exploratory drilling on NG in China and says it thinks the reserves can be developed economically.]

Shell is also "examining plans to liquefy US gas for export - which would allow it to attract higher prices, particularly in Asia - transform it into clean-burning transport fuel through gas-to-liquids technology, and use it as a feedstock for petrochemicals." That's a quick rundown of the range of economic opportunities - in addition to displacing coal in electricity.

All good stuff and an integral part of America's coming industrial renaissance.

Asia,

Asia,  US,

US,  energy,

energy,  extractive industries,

extractive industries,  global economy | in

global economy | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article