THE big global long-term financial threat: Asia's "flowering" welfare states

Thursday, September 20, 2012 at 12:03AM

Thursday, September 20, 2012 at 12:03AM  Excellent Economist piece.

Excellent Economist piece.

Idea I've spoken about before: Asia has been the savings center of the global economy for a while. The West (outside the oddly still-young US) is slouching toward retirement, when traditionally a society needs capital because it's burning up its own. Meanwhile, the South is like a young couple that needs start-up capital.

Point is, we expect Asia to fund both - plus take care of its own continuing rise.

The good news: while China's demographic dividend shrinks from here on out, SE Asia's will be around for decades, as will that of the emerging demo-div King Kong - India.

But what happens if Asia adopts the West's cradle-to-grave welfare state model? Or what the Economist dubs "tigers turning marsupial"?

The Economist's point: forget Asian values. When societies reach a certain level of wealth, people expect the same things the world over.

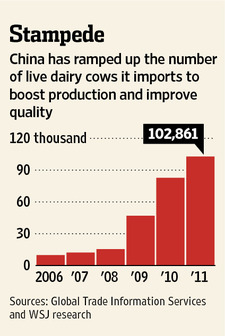

It seems that every country that can afford to build a welfare state will come under mounting pressure to do so. And much of Asia has hit the relevant level of prosperity (see chart 1). Indonesia is now almost as developed as America was in 1935 when it passed the landmark Social Security Act, according to figures compiled by the late Angus Maddison, an economic historian. China is already richer than Britain was in 1948, when it inaugurated the National Health Service (NHS) which, to judge by political ructions—and Olympic opening ceremonies—has become crucial to its sense of national identity.

We are expecting a lot from Asia between now and 2050 . . ..