We need to talk about Egypt

Wednesday, March 27, 2013 at 12:46AM

Wednesday, March 27, 2013 at 12:46AM  Nice piece by Roula Khala in the FT on the unfolding crisis that is Egypt’s economy. To no one’s surprise, the Muslim Brotherhood has proven rather inept at economic management – much less reform. One can hope that the learning curve, while steep, is rapidly surmounted, but there’s always the temptation of long, out-of-power revolutionary types to imagine that “now is our time to prove there is an [INSERT NATIONALITY HERE] way of doing things!”

Nice piece by Roula Khala in the FT on the unfolding crisis that is Egypt’s economy. To no one’s surprise, the Muslim Brotherhood has proven rather inept at economic management – much less reform. One can hope that the learning curve, while steep, is rapidly surmounted, but there’s always the temptation of long, out-of-power revolutionary types to imagine that “now is our time to prove there is an [INSERT NATIONALITY HERE] way of doing things!”

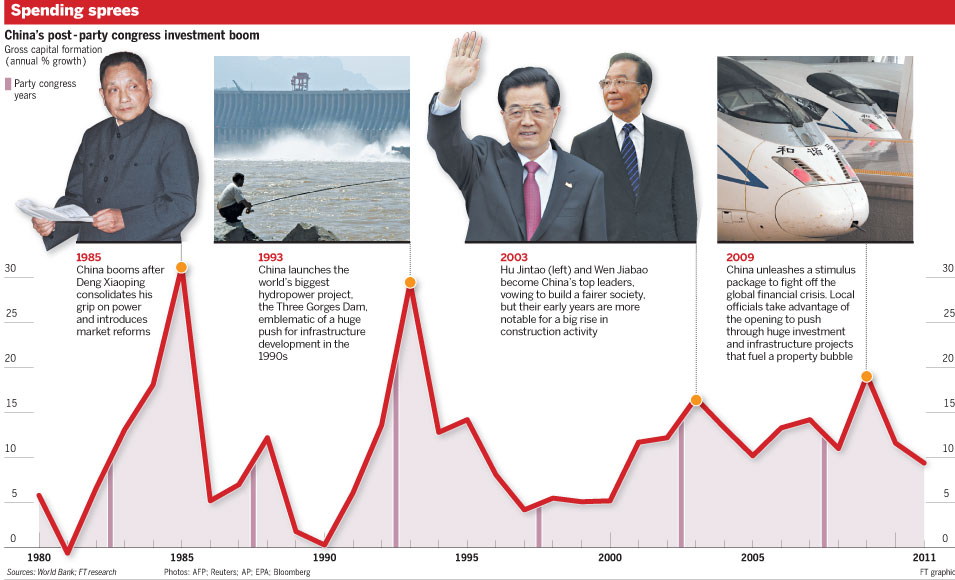

Over time, genuine economic development forces convergence: there are a few models out there (centralized socialism, oligarchic capitalism, state-run capitalism, big-firm capitalism and entrepreneurial capitalism) and there are pathways from one to the other (e.g., Russia from centralized socialism to oligarchic capitalism, China from centralized socialism to state-run capitalism, Japan from state-run capitalism to big-firm capitalism, Singapore from state-run capitalism to entrepreneurial capitalism, America from big-firm capitalism to a hybrid of that + entrepreneurial capitalism (i.e., industry sectors dominated by a handful of go-to-market options, surrounded by a sea of entrepreneurial small firms)). But everyone ends up running the same pathways – to wit, state-run China dreams of achieving its own Goldilock-style mature capitalism by “going global” in the direction of big-firm capitalism, pursuing “indigenous innovation” in the direction of entrepreneurial capitalism, and splitting the difference with domestic-led consumption (basically, the US model).

So no, there isn’t anything new under the sun; there’s just the same old game of hopscotch.

The fundamental flaw of the MB in power to date, according to Khalaf:

Mr Morse, an Islamist, has yet to understand that politics and the economy cannot be managed separately. A lack of political consensus is destroying his chances of taking difficult austerity measures, including cutting a costly subsidies bill and raising taxes, all of which are required by the IMF.

The IMF only matters here because of a $5B loan agreement on the table. Yes, Mr. Morsi can try to sell Egypt to China for a similar amount, but there he might find that the new neo-colonialism practiced by Beijing (you sell us raw materials and we sell you finished goods) isn’t the great liberation it’s made out to be for a country with such massive underemployment (and no serious material wealth). It’s hard to follow the China model unless you’re China, which means it’s not really a model at all.

Khalaf preaches an IMF programme (oops, went Brit there for a few strokes) “accompanied by substantial funding from an international support group made up of Western powers and Middle East oil states.

Me? I would hope Egypt might split the difference and go for a bigger international support group that includes rising Eastern economies. Because if it’s just the West and oil-rich sheikhs making demands, that gives Morsi the ideological “out” of resistance. So including China and India et al. in such things would be a nice way of evening out the demands, the message, and sense of us-against-them.