Signs of the coming agricultural interdependency

Monday, June 4, 2012 at 12:54PM

Monday, June 4, 2012 at 12:54PM FT story on Marubeni, the Japanese trading house, buying US grain trader Gavilon - a major corn trader.

Why buy it? China's recent forays into the US corn market suggest the rise of a similar long-term relationship as did early Chinese forays on soybeans years ago. China now regularly imports massive amounts of US soybeans. A similar long-term transactional relationship now seems in the works regarding corn. Marubeni already has an agreement with Sinograin, a state-owned Chinese company that manages the country's strategic food reserves.

Military strategists of varying levels of economic awareness imagine the US, Japan and China fighting naval battles over the South China Sea. Meanwhile, truly deep economic/resources dependencies - such as these in food - are cropping up all over the place.

Guess which relationships prevail?

And no, comparing this to globalization-cum-1914 is too ludicrous a notion to process. It isn't comparing apples to oranges; it's comparing apples to mammals.

BTW, growing up on the edge of the US corn belt (SW Wisconsin), this issue is near and dear to my heart.

Reader Comments (2)

My father is a farmer, and he is grateful for the high price their corn and soybeans bring these days as a result of the high demand.

Unfortunately he has to take his grain across the Mississippi by ferry to the co-op in Illinois, because the local grain elevator, owned by Bunge North America Inc., regularly downgrade the quality of grain brought to them in order to cut the price they pay farmers, and thereby upping their profit margins.

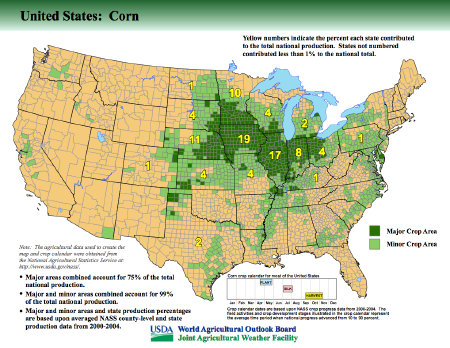

The U.S. will grow as many acres of corn in 2012 as it did in 1935, which is about 95 million acres. The location of corn production has not changed much since then. Take a map of the U.S. tall grass prairie from the 1830's and lay it over the corn production map from above and you'll see why corn is grown where it is. That is where the soil and the moisture is at.