FT story on Marubeni, the Japanese trading house, buying US grain trader Gavilon - a major corn trader.

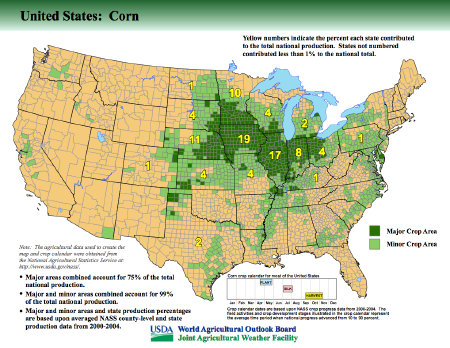

Why buy it? China's recent forays into the US corn market suggest the rise of a similar long-term relationship as did early Chinese forays on soybeans years ago. China now regularly imports massive amounts of US soybeans. A similar long-term transactional relationship now seems in the works regarding corn. Marubeni already has an agreement with Sinograin, a state-owned Chinese company that manages the country's strategic food reserves.

Military strategists of varying levels of economic awareness imagine the US, Japan and China fighting naval battles over the South China Sea. Meanwhile, truly deep economic/resources dependencies - such as these in food - are cropping up all over the place.

Guess which relationships prevail?

And no, comparing this to globalization-cum-1914 is too ludicrous a notion to process. It isn't comparing apples to oranges; it's comparing apples to mammals.

BTW, growing up on the edge of the US corn belt (SW Wisconsin), this issue is near and dear to my heart.