A graphic listing most - but not all - of the sims conducted by Wikistrat this year. The point is to display the breadth and the volume. Be impressed, because you should be.

Wikistrat's sims aren't a year in the planning. Client names the subject and we're off and running in days. Why? All Wikistrat needs is a framework and then we turn the analysts loose on the scenarios. The company don't spend countless man-hours narrowing down the range of possibilities so that 95% of the uncertainty and surprise is drained from the exercise by the time we actually start it. Wikistrat can customize the structure to your concerns and then it brings the masses in to run with that structure and take it places you - the client - hadn't considered.

That approach allows for a huge mapping of possibilities. You want to find the needle in the haystack? Well, Wikistrat can run through that hay awfully damn quick.

Spend a minute and see if you can guess the four sims that were my ideas . . .

{music}

First one was China as Africa's de facto World Bank. I'm pretty sure that was based on a WSJ headline noting that tipping point. It ended up positing a lot of interesting intersection points between the US and China on the continent. Sim ended up generating both a report and a briefing by me.

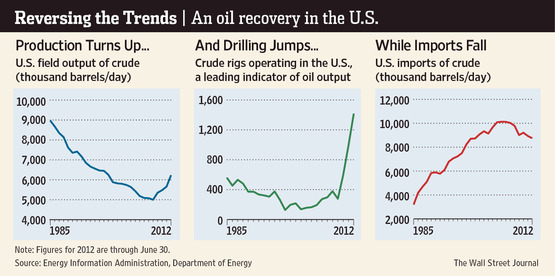

Second one was the North American Energy Export Boom. There was a time when Wikistrat asked me what I'd most like to explore in terms of near-term uncertainty in the system, and the whole fracking thing just jumped out at me: Which way does it go? Does it work out big-time for the US and - ultimately - the world? Or does it get aborted like nuclear power for enviro reasons? That was a very strong sim in terms of output, and all that material (final report and my brief) still tracks incredibly well with headlines. All we did is simply systematize all those possibilities, organizing them into four major trajectories (usual X-Y approach). But the upshot was, anybody who goes through that stuff now has the capacity to process all the headlines to come.

Third one was the China slowdown sim. That one's been in my mind since I wrote the piece for Esquire back in the fall of 2010 (it came out in the Jan '11 issue). The idea came to me in the summer of 2010 and it took a while to sell it to the magazine, but it looks fairly prescient today, doesn't it? Anyway, a very solid sim that ran down all manner of possibilities, and I really loved the quartet of scenarios we came up with (which drew comparisons to historical risers). Great report and probably the strongest brief I've yet done for WS.

Fourth one was "when China's carrier entered the Gulf." Wikistrat asked me to generate a host of possible sims way back when, and that was one of them. Just a simple logical progression argument, with the trick being imagining all the possibilities when that inevitability unfolds. Hence the sim, which turned out great, along with a solid report. And this one was only a "mini-sim" by WS standards: just a brainstorming drill on scenarios with a quick follow-up on policy options. Mostly junior analysts, but the output was as good as anything I've seen from the National Intelligence Council - seriously.

Two on the list I didn't really have anything to do with: NATO and Pakistan. First one was driven by a client's curiousity. Second one is just a natural "what if?" Both turned out quite nicely.

The Democratic Peace Theory Challenged sim is another one I did not design, and I will admit that, at first blush, I didn't much care for the subject. I was brought in to work the design and shaped it somewhat, but I truly had low expectations. In truth, those were exceeded by a long shot. The material needed more shaping than usual, because the sim had a theoretical bent, but what I ended up with at the end in the final report was . . . to my surprise . . . quite strong - I mean, present at a poli sci/IR conference strong (or walk into any command and brief strong). It easily could have veered into all sorts of panic mongering, but instead it organized a universe of possibilities very neatly. I was really proud of the overall effort, and it reminded me not to get too judgmental going into sims.

The Syria sim I didn't design, nor did I oversee its operation. That Wikistrat left to junior versions of myself. I was brought in at the end to shape the first draft of the report, and, while I moved things around plenty, the material held up very nicely to my critical eye, which is encouraging. If Wikistrat is going to handle all the volume coming down the pike (contractual relationships are piling up at a daunting rate), then the Chief Analyst position needs to be like that of any traditional RAND-like player: that person needs to be able to shape things a bit at the start and then at the end, but mid-range staff need to be able to herd all those cats and the resulting material. So that one felt like a nice maturation of the process, because, like with any successful start-up, the real challenge isn't marketing but execution.

This graphic, for some sad reason, skips the headlining sim of the year to date: When Israel Strikes Iran. That one I had a lot of fun with, giving it my years-in-the-testing phased approach (initial conditions, trigger, unfolding, peak, glide path, exit, new normal). That approach goes back to my Y2K work and later after-action on the Station Nightclub fire disaster in Rhode Island (done for the local United Way to provide lessons learned on how well the organization responded). That was the most structurally ambitious Wikistrat sim to date and it - unsurprisingly - produced the best material by far. I'd put that final report and brief up against anything the best elements of the US national security establishment could produce . . . naturally at about 20 times the cost and five times the duration of effort.

The graphic also doesn't include the most recent sims. I just finished a final report on The Globally Crystalizing Climate Change Event (one of mine), and, despite the great time projection, I was pleasantly surprised at how well the material holds up in the report. I thought the analysts did a great job there.

Based on that fine crowd performance, Wikistrat pushes the community even harder in the just-wrapping-up sim entitled When World Population Peaks. This one was truly challenging, but my point in designing the sim was almost to purposefully "test out" analysts in the manner of a language-skills oral exam, meaning I wanted something almost too hard for most analysts so as to press both them and the supervising analysts on how they handled it. Think of it like a NASA sim where Control is trying to crash the lunar module. That was a bit stressful, I think, for a lot of the community who participated, but - to me - it was like a nasty cross-country workout (I am assistant coaching my kid's team again for the 8th year in a row and I'm on my third kid) early in the season: bit of a bitch mentally and physically, but it'll pay off down the road.

Yes, Wikistrat does take all its sims - even the training ones - very seriously. If you're not growing then you're dying - simple as that. Start-ups have to have that survival-of-the-fittest mentality and we're talking about a small firm that's come out of nowhere (okay, Israel) in just three years.

So, a nice overview of the year, and it's an impressive body of work. Would you believe me if I told you that all of it was accomplished within a timeframe and with a far smaller budget that one of those bloated wargames that Booz Allen runs for the Pentagon?

Well, if you did, then you'd know why Wikistrat is going to succeed in this cutthroat business.

Thursday, October 18, 2012 at 9:49AM

Thursday, October 18, 2012 at 9:49AM

Europe,

Europe,  US,

US,  US foreign policy,

US foreign policy,  globalization | in

globalization | in  Chart of the day |

Chart of the day |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article