Good article start, which, in true inverted pyramid fashion, gets all the work done right up front.

Good article start, which, in true inverted pyramid fashion, gets all the work done right up front.

India is facing an energy crisis that is slowing economic growth in the world's largest democracy.

At stake is India's ability to bring electricity to 400 million rural residents—a third of the population—as well as keep the lights on at corporate office towers and provide enough fuel for 1.5 million new vehicles added to the roads each month.

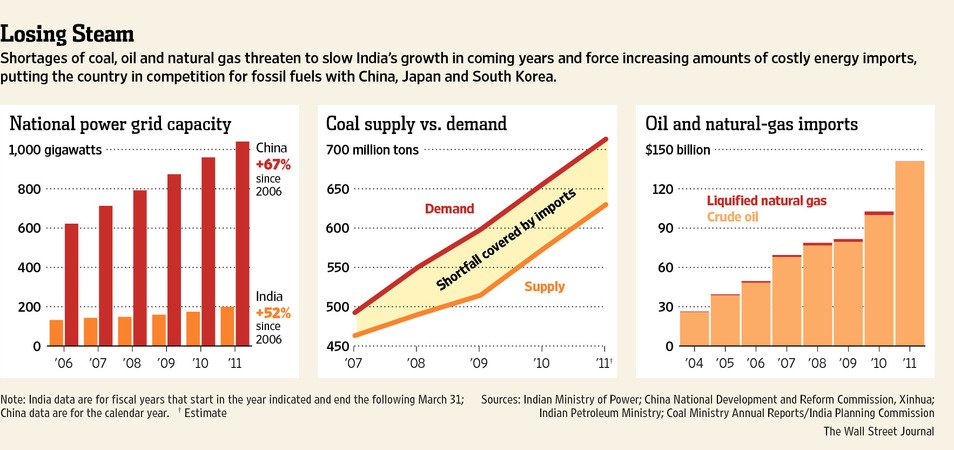

Shortages of coal, oil and natural gas will require India to import increasing amounts of high-cost fossil fuels, say energy experts, risking inflation and putting the country in stepped-up competition with China, Japan and South Korea. Buying oil from Iran, one of India's biggest suppliers, is tougher because of U.S. and European sanctions aimed at curbing Tehran's nuclear ambitions.

With annual demand expected to more than double in the next two decades to the equivalent of six billion barrels of oil, the energy crunch threatens to knock India off its growth path. The national economy has already slowed amid paltry business investment and stalled reforms. It tallied just 5.3% growth in the quarter that ended March 31, the lowest level in almost a decade and well shy of the country's 9% goal.

With annual demand expected to more than double in the next two decades to the equivalent of six billion barrels of oil, the energy crunch threatens to knock India off its growth path. The national economy has already slowed amid paltry business investment and stalled reforms. It tallied just 5.3% growth in the quarter that ended March 31, the lowest level in almost a decade and well shy of the country's 9% goal.

The charts above lay out the problem: Electricity growth is pretty much a proxy for GDP growth. If you want to grow your economy fast, you have to grow your grid capacity similarly. China is getting it done. India is not.

The oil imports stuff is pretty classic for the trajectory: roughly a 5-fold increase since just 2004. I see this growing demand expressed in deals I'm structuring.

But the one that jumped out at me, per the recent Wikistrat sim on "North America's Energy Export Boom," was the coal shortfall now covered by imports. Our sim was mostly about natural gas, of course, but the displacement effect in electricity generation means we have a lot of stranded coal capacity emerging here in the US - coal that could go abroad effectively because it's energy quotient is world class. The story describes recently constructed coal-burning electricity-generation plants that are operating below capacity - or worse, are idled - for lack of coal.

I've seen industry estimates by US coal experts that say India will be a prime source of export growth over the next couple of decades. This article makes clear the "why."