Report: NATO members foil Mumbai-style wave of attacks on Europe

Wednesday, September 29, 2010 at 8:44AM

Wednesday, September 29, 2010 at 8:44AM

From Michael Smith, the gist of the Sky News report:

Intelligence agencies have intercepted a terror plot to launch Mumbai-style attacks on Britain and other European countries, according to Sky News sources.

... militants based in Pakistan were planning simultaneous strikes on London and major cities in France and Germany . . . the plan was in the advanced but not imminent stage and the plotters had been tracked by spy agencies "for some time".

Intelligence sources told Sky the planned attacks would have been similar to the commando-style raids carried out in Mumbai . . . the European plot had been "severely disrupted" following intelligence sharing between Britain, France, Germany and the US.

It is not known whether the attackers are already in Europe.

News of the planned strikes came as the Eiffel Tower in Paris was evacuated because of a bomb scare for the second time in two weeks . . .

When the terror plan came to light, the US military began helping its European allies by trying to kill the leaders behind the plot in Pakistan's Waziristan region.

There have been a record 20 missile attacks using drone aircraft there in the past 30 days.

Why it's important to pay attention:

- It's long been my contention that extremists operating in NW Pakistan, most likely in some collusion with al Qaeda (not a big leap), will keep trying to make some big splashy strike in the West. Many experts saw the Times Square bombing attempt as a practice run using an expendable. Figuring how hard that is to pull off--in a relative sense, and with AQ and its net falling from our collective memory thanks to the economy, the default alternative for such groups to regrab the headlines is to do something easy and cheap like Mumbai II and to do it in Europe. So yeah, I find this whole logic believable.

- I think Obama is right when he says, we can absorb another attack without freaking out. I don't think we would, having gone through Afghanistan and Iraq since and understanding that such unilateralism just leaves us holding the bag. So the next strikes, I believe, can lead to more interesting and better cooperative opportunities with Russia, China, India, Turkey, et. al, if done well. Is Obama the guy to do it? While I don't think Americans would freak, I fear another attack would simply give the man another chance to come off as far-too-Vulcan for the average American voter. While I think we're still in philosopher-king political mode and will be for a while, I think his off-putting style will mean we'll stop reaching for the smartest-guy-in-the-room option, because that guy should be the brilliant adviser (which Obama lacks because his smartest-guy-in-the-room mindset attracts other big egos and sycophants and apparently not much in between) and not POTUS himself, who should be all about leading and not aspire to such a title. Therefore, I do not see a rally-round-the-prez dynamic unfolding when it eventually happens. That bad feeling will simply be piled upon the existing glut of bad feeling about the economy.

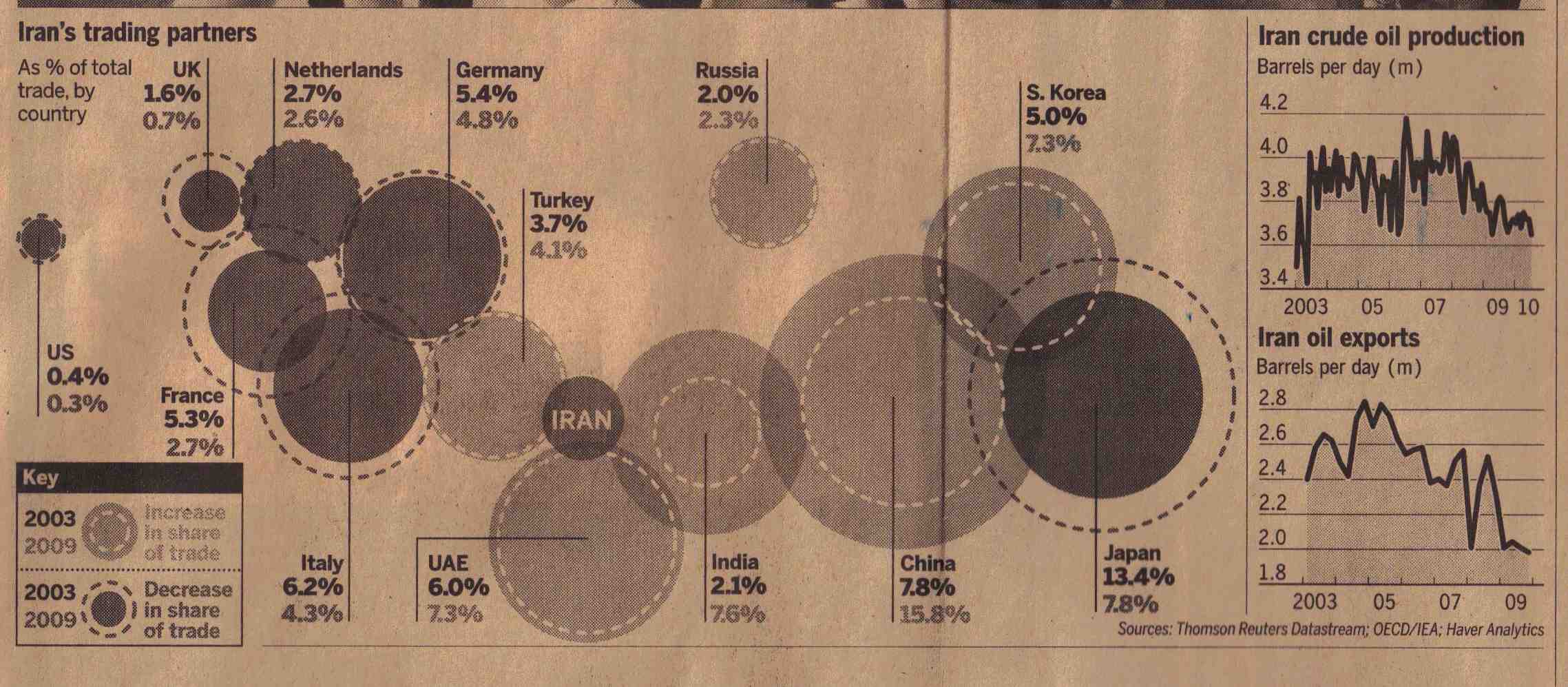

- The other side's ability to sked our counter-reactions is a real problem, because, in our habits, we feel the need to "keep all balls in the air," so terror competes with WMD in NorKo and Iran competes with our growing fears of Chinese military build-up competes with global warming competes with . . .. What was nice about the post-9/11 period was the willingness of great powers to clear the decks on most everything else, keeping them in some big-picture perspective mode, and exploiting the common threat opportunity embodied by AQ to contemplate a serious recasting of the great power relationships for the better. But then Bush-Cheney went wild on the unilateralism/primacy and that moment was largely wasted. Can it happen the next time a crystalizing attack occurs? Sadly, I don't see the leadership anywhere in the world to take advantage, so we go on with the current situation, where everybody is juggling balls and no serious progress is being made on anything. Meanwhile, mutual suspicions pile up, and increasingly we've all got enough gripes with every other great power to make cooperation an almost tortured affair. I'm not secretly wishing for something bad to happen; that is a dangerous intellectual route to go for someone who thinks seriously about the future. The point is, I don't have to. Globalization's penetrating speed has not abated one whit with the great recession--anything but. We're only dimly aware of that here in the States because we think that drawing down in Iraq and hoping to do the same in Afghanistan is a big deal for the system, when, in truth, it barely notices it right now and continues down its aggressive integrating path. In short, we assume it's Old-Core-does-Gap-or-nobody-does-Gap, when in truth, it's New-Core-does-Gap-systematically and compared to that, the West's efforts are marginal and concentrated in bits and pieces. I'm not looking to go back to the frantic push the US made after 9/11. I'm looking for a better marrying up of those two efforts, because the mismatches in resources are vast and the big opportunities for new collaborations are slipping away. AQ or others will accommodate that need whether we want it or not. That's the dynamic we're in right now with globalization pushing into previously disconnected places with such force that serious blowback will be the norm for the foreseeable future. Yes, we can dream it'll all come down to some naval battle in the South China Sea, but that's just habit talking. And that's what I find so sad right now: that whole "juggling the balls and keeping all of them in the air" mentality of Clinton and Obama is just a placeholder for real leadership, which events will eventually demand. Why? Because they will keep trying and eventually they'll get our attention. As always, what we'll do in that moment will be far more important than the vertical shock laid on us. Nation-states still run horizontal scenarios to ground, meaning the question of the day is, "When the next vertical shock comes, where will go with it?"

- Then tack on Obama's statement to Woodward that "We need to make clear to people that the cancer is in Pakistan." I guarantee you, the next scheduled-by-our-enemies response (when the drones aren't enough) will induce a serious calibration effort/opportunity with both China and India.

And that's why I pay attention to stories such as this.

China,

China,  India,

India,  Pakistan,

Pakistan,  US foreign policy,

US foreign policy,  globalization,

globalization,  terrorism | in

terrorism | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article