US farmers: China's rise is good

Monday, August 2, 2010 at 12:08AM

Monday, August 2, 2010 at 12:08AM  Nice FT story with charts on how “US farmers cash in on China demand.”

Nice FT story with charts on how “US farmers cash in on China demand.”

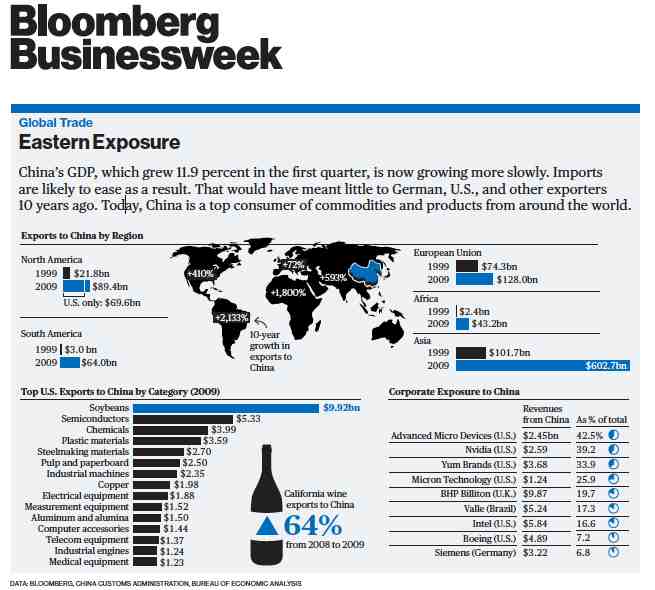

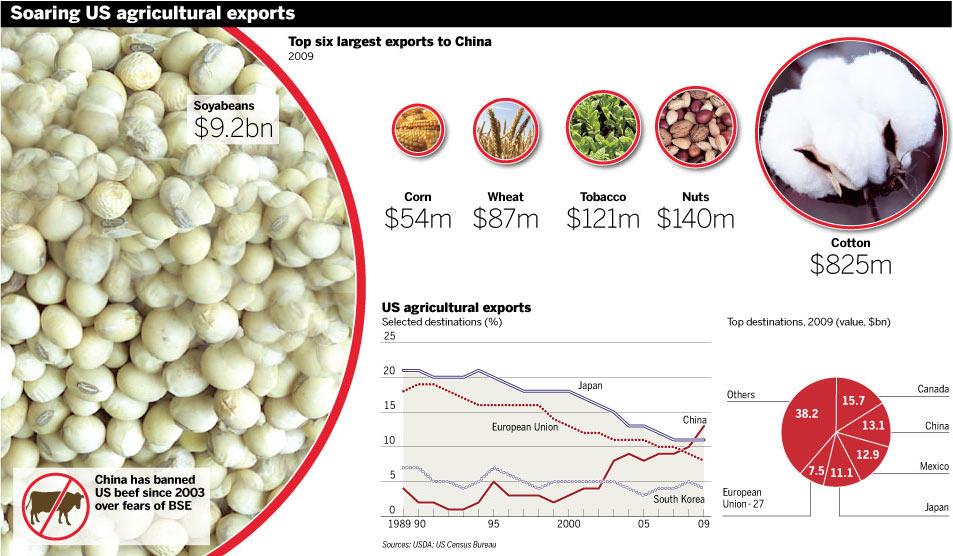

US ag exports to China now surpass those to Japan, the EU and South Korea, all of which are declining while China’s imports come out of nowhere in 2000 to almost a five-fold increase since.

Biggest flows are soybeans (Indiana’s reason to live) at almost $10B, then cotton (under a billion), then nuts (peanuts at just $140m), tobacco, wheat and corn.

The bad spot: China bans our beef since the minor BSE scare in 2003 that sent our beef exports plummet from $1.3T to about $.3T overnight (still hasn’t recovered).

Sign of the times: the first US grain export depot built in 25 years since on the West coast, so say goodbye to a bunch of those barges heading down to the Big Easy on the Mississippi.

As US politicians lose sleep over the trade deficit with China and the dollar-renminbi exchange rate, American farmers are eyeing a record $14bn in exports there this year. So naturally the logistical landscape is being reformatted.

Hyped this one a while back in a column, and yeah, exports “exploded” after the Chinese joined the WTO in 2001. One expert says that one-third of the price on the Chicago Board of Trade is determined by China.

For now, US dairy exports held up, awaiting new Chinese certification reqs. Our poultry faces a lot of “antidumping” obstacles, so work to be done.

China’s government has made self-sufficiency in ag production a national goal, but that’s a dream at best, given how much of China’s breadbasket is located at or below the 35th parallel, meaning more and lengthier droughts as global warming kicks in more extensively.

We are likely to have China over a breadbasket soon enough, my friends, despite Beijing’s attempts to buy up farmland all over the Gap.

For now, Canada remains the top destination for US ag exports (which I find stunning!) at $16B, then China at $13B, then Mexico at $13, then Japan at $11b, the EU at $8B and the ROW at $38B.

That’s a heap of billions—almost 100!

China,

China,  agriculture,

agriculture,  global economy | in

global economy | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article