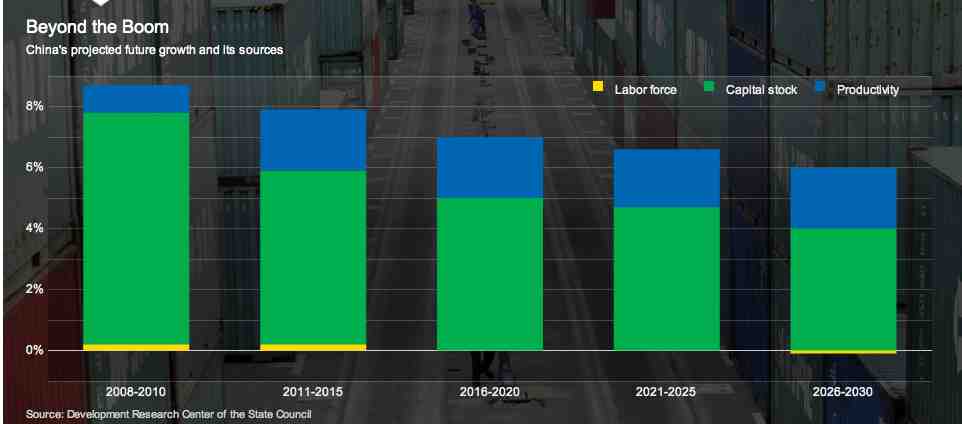

To be filed under “economic reality”: A WSJ chart that projects likely decline of Chinese GDP growth rate in the years ahead.

To be filed under “economic reality”: A WSJ chart that projects likely decline of Chinese GDP growth rate in the years ahead.

Simple enough logic: the bigger the economy, the harder it is to get the same percentage growth. Plus, once all the easy extensive growth achieved, harder to make the intensive growth happen (productivity and innovation versus just building more-more-more!).

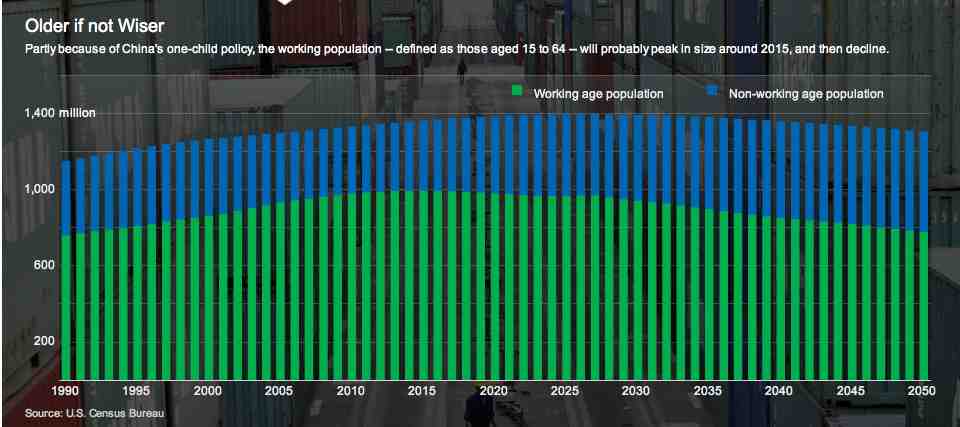

Then there’s the rising cost of labor as the labor pool shrinks relative to the rising dependency ratio (nonworking youth and accumulating pool of elders that will transform China into a civilization that got old before it got rich).

Yes, China will move manufacturing inland and westward to develop its interior (that which isn’t lost to competitors both near and far), but that will degrade the cost advantage further.

Peaking of labor population driven home in accompanying chart on jump page (peaks in 10s and then declines to pre-90s level through 20s, 30s,40s—ad infinitum.

Other jump-page charts show that China is following the same path as Korea and Japan previously—the golden period cannot last forever, because this isn’t a new economic model whatsoever.