After the success of the "China as Africa's de facto World Bank" simulation, we start moving expressedly into a series of sims aimed to flesh out the logic of the world's first crowd-sourced strategy book, the proposal for which we're now circulating in NYC. It was about time for me to gin up another, and I was really looking to do something different because I feel like I got my "vision" out in the trilogy. Plus, I wanted to do something long-term in its thinking. More details later as things unfold.

For now, we tee up the first of about a half-dozen major sims that will explore the drivers of a particular future world order that I became intrigued with as a result of last summer's Wikistrat Grand Strategy Competition. To me, how the NorthAm energy boom (question mark suggests nothing in this world is a given) unfolds is one of the major global uncertainties. North America can get it right or wrong on a host of levels, and since we're the inventors of these fracking revolution, the QWERTY effect would be huge, triggering a host of possible future pathways from fabulous to self-desructively nasty in terms of the environment and/or whether or not this great gift becomes an excuse for bad geostrategic choices by the U.S., China, Europe, Brazil, India, Russia - the big six we're focusing on here. You can say, it's a simple projection: it works or it doesn't. But the secondary and tertiary pathways that are revealed in this two stage process (NorthAm leads, others follow or ignore) are varied and immense in their capacity to make global stability better or worse.

So, naturally, I'm pretty pysched about the sim. One thing to go and read a bunch of books and try to get smart enough to cover this in a book, but another to turn loose dozens-to-hundreds of virtual co-authors in a competitive space to brainstorm all the possibilities.

Especially exciting for this sim: we now have senior experts stepping in and providing big-time ideas. Dr. Anne-Marie Slaughter, just out from the Kennan job at State (Policy Planning) under Obama, joined Wikistrat weeks back and she brings not just a wealth of experience and keen insight, she's also a not-too-closeted enthusiast for this sort of social networking as a tool to drive new thinking and change old thinking. She's already made a huge contribution to the sim that lays out, in a very clever way grounded in real-world vehicles, how a positive path in NorthAm could go global (as a fellow optimist, my attraction to her scenario was immediate, not because it was rosy per se, but because she elucidated why, given the parameters, this was the best forward-moving deal for the universe of public and private-sector actors working this policy space now in the U.S.).

Other senior experts piping in with their own scenarios include: Gary Hunt, president of Tech and Creative Labs, a tech mash-up that moves software solutions into the energy vertical market; and Chris Cox from Gesellschaft für Konsumforschung (GfK), Germany's oldest consumer research org (Chris comes with an energy focus on the fmr USSR realm).

But, as always, the coolest outlier ideas come from the Wikistrat rank and file, and that's the way we love it: "big firm"/senior experts with the go-to-market pillar concepts that structure the sim, and our "sea of entrepreneurs"/younger analysts with all the just-on-the-edge-of-plausibility stuff that most of us seniors have had beaten out of us by experience and bad bosses. Already there's been a nice cluster of jaw-dropping ideas out of this bunch, many of which see major players gaming the process very cleverly (both in a nice and nasty way).

I've been chiming in throughout on the scenarios ginned up to date (about two dozen). Each results in a wiki page that gets fleshed out across a dozen or more fields, to make sure we're collectively thinking out the scenario to the degree of robustness. I had given the pool of analysts my notional master narratives (simple frameworks for putting all these scenarios into "bins") and they've responded nicely by distorting the implied framework with all sorts of surprises I hadn't anticipated. At the end of the week I'll array and string together all these scenarios and rejigger the master narratives to cover enough of them for the next phase of the sim to unfold: brainstorming competiting notions of how these master narratives impact the strategic interests of our six-pack of great powers.

My only fear? How to stuff all these ideas into one book? But this is a good problem to have.

Tuesday, April 24, 2012 at 12:02AM

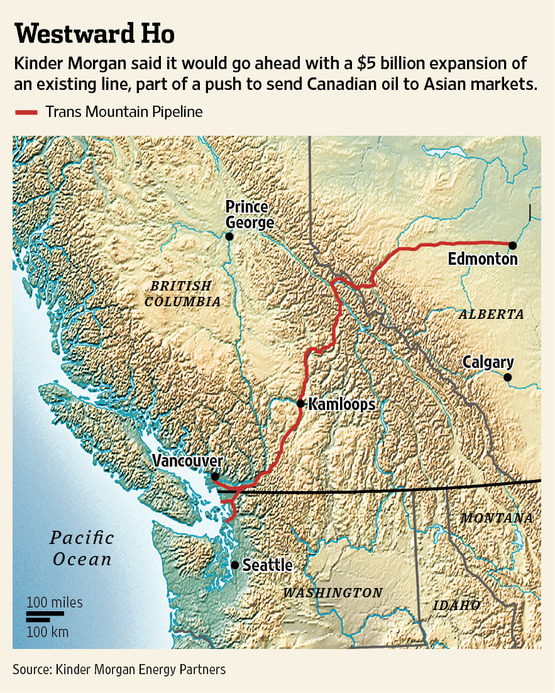

Tuesday, April 24, 2012 at 12:02AM  Per the recent Wikistrat simulation (North America's Export Energy Boom), Canada grows weary of the complications of exporting energy to the US market (see Keystone XL) and starts to spot easier venues going West to Asia:

Per the recent Wikistrat simulation (North America's Export Energy Boom), Canada grows weary of the complications of exporting energy to the US market (see Keystone XL) and starts to spot easier venues going West to Asia: Asia,

Asia,  US,

US,  energy,

energy,  extractive industries,

extractive industries,  global trends | in

global trends | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article