Africa: a place NOT to leave alone

Friday, February 18, 2011 at 11:17AM

Friday, February 18, 2011 at 11:17AM George Friedman's new book, "The Next Decade," presents his usual shtick that looks suspiciously like a rerun of WWII (as all his stuff does). We are made to believe the Japanese threat is still there (Friedman is still trying to justify his early 1990s book that said war with Japan was inevitable), that China will fragment (oh so InterWar), and that Russia and Germany will ally in a frightening Molotov-Ribbentrop way (no kidding! that's why we must quickly ally with Poland!).

But the bit that got me was his chapter on Africa, which he entitled, "A place to leave alone." Why? By his geopol standards, it isn't coherent enough to create a dominating challenger to US global empire, so no reason for US to go there whatsoever.

Interesting perspective.

I would tell you that Africa is going to be the ground zero for globalization's economic and network integration over the next 2-3 decades, as in, a very happening and increasingly coherent place. But no, no hegemonic dragons for the US to slay.

And you have to ask yourself: is that all there is to US grand strategy? Preventing the rise of challengers and asserting primacy? Because I thought that path got explored fairly aggressively in Bush-Cheney to almost nobody's satisfaction. And are we, on the basis of such thinking, simply supposed to ignore major chunks of the world?

Again, brilliant stuff if your goal is to shape Eurasia prior to, during and following WWIII there (read Friedman's hilarious "Moonraker" war between Japan and the US on the dark side of that celestial body in his "Next 100 Years"), but my reading of US grand strategy since around 1900 is all about creating that open door-cum-post WWII international liberal trade order-cum-the West-cum-the global economy-cum-globalization. To me, the goal of primacy (deflecting all rising would-be competing great powers) is entirely unAmerican. It's simply not who we are as a people or what we've done these last several decades as a superpower.

But Friedman completely ignores the concept and reality of globalization, preferring his stated dream that Americans finally realize they're running a world empire (honestly! he's sticking with this fantasy after the Global Financial Crisis revealed a world a bit more balanced than he cares to admit). Check out either book and you will see virtually no references to globalization (albeit one on globalization in the 16th century in "Next 100 Years") - as if he simply doesn't "do" globalization. And that's why his books have a weird, back-to-the-future feel whereby we're still worried about Russo-German schemes to rule the world!

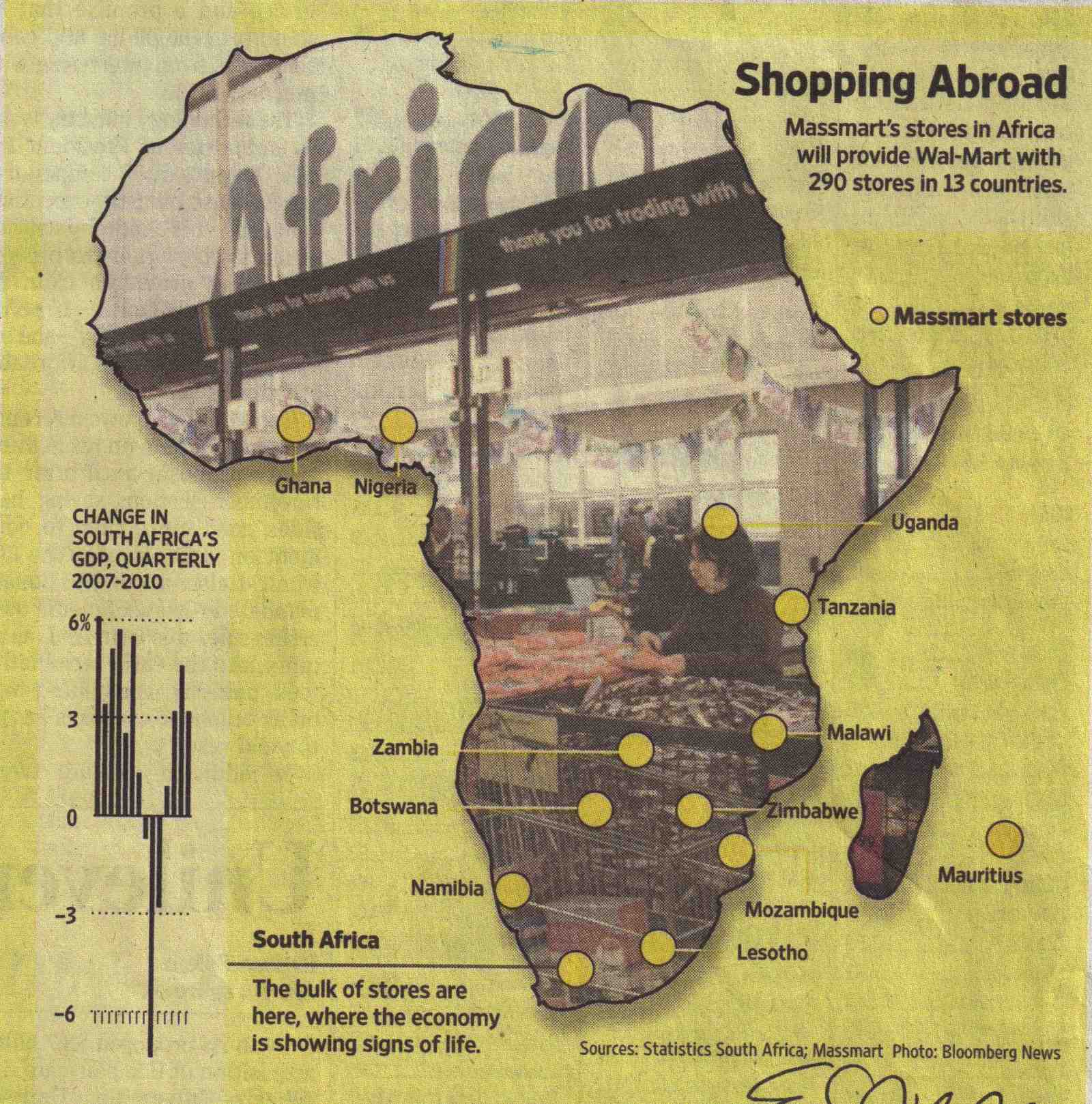

Better than reading Friedman's WWII redux material, check out the WSJ's running serial on the emergence of the middle class in Africa, hence my chart of the day:

This is why Wal-Mart doesn't consider Africa "a place to leave alone," nor should any serious global corporation.

This is why Wal-Mart doesn't consider Africa "a place to leave alone," nor should any serious global corporation.

Nor, frankly, should the US.

We have to be able to see a world for what it is, not for what we're conditioned to look for. Friedman still sees the world in terms of great powers balancing each other out of the 1920s-1930s, because that's what he was classically trained to see. But I ask you, how is his persistence in spotting what he wants to spot any different from a religious type who keeps seeing "clear evidence" of the Book of Revelations in events in the Middle East? Both of these characters have their preferred storyline from the past, and by God, they ain't swapping it out for anything!

To me, that's not teaching people how to think strategically, but the exact opposite. It's providing a familiar, fixed box and then encouraging readers to lop off those limbs of the world body that do not fit this Procrustean bed - like Africa.

And unfortunately, that sort of approach yields a solid 2-3% capture of globalization's fascinatingly dynamic and complex reality. Get smart at viewing that holistically and you've got a grip on the world as we know it.

Or you can fantasize that America's grand strategy of this decade is thwarting Japan's resurrected militarism and Russo-German schemes to dominate the heartland of Europe!

Achtung baby!

Friedman's memo to China: you're conquering the world all wrong!

China to Friedman: very true, and completely irrelevant.

Africa,

Africa,  global middle class | in

global middle class | in  Chart of the day |

Chart of the day |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article