WSJ and FT pair of stories. Scanned graphic from latter.

Apparently, Wal-Mart didn't get the "deglobalization" memo.

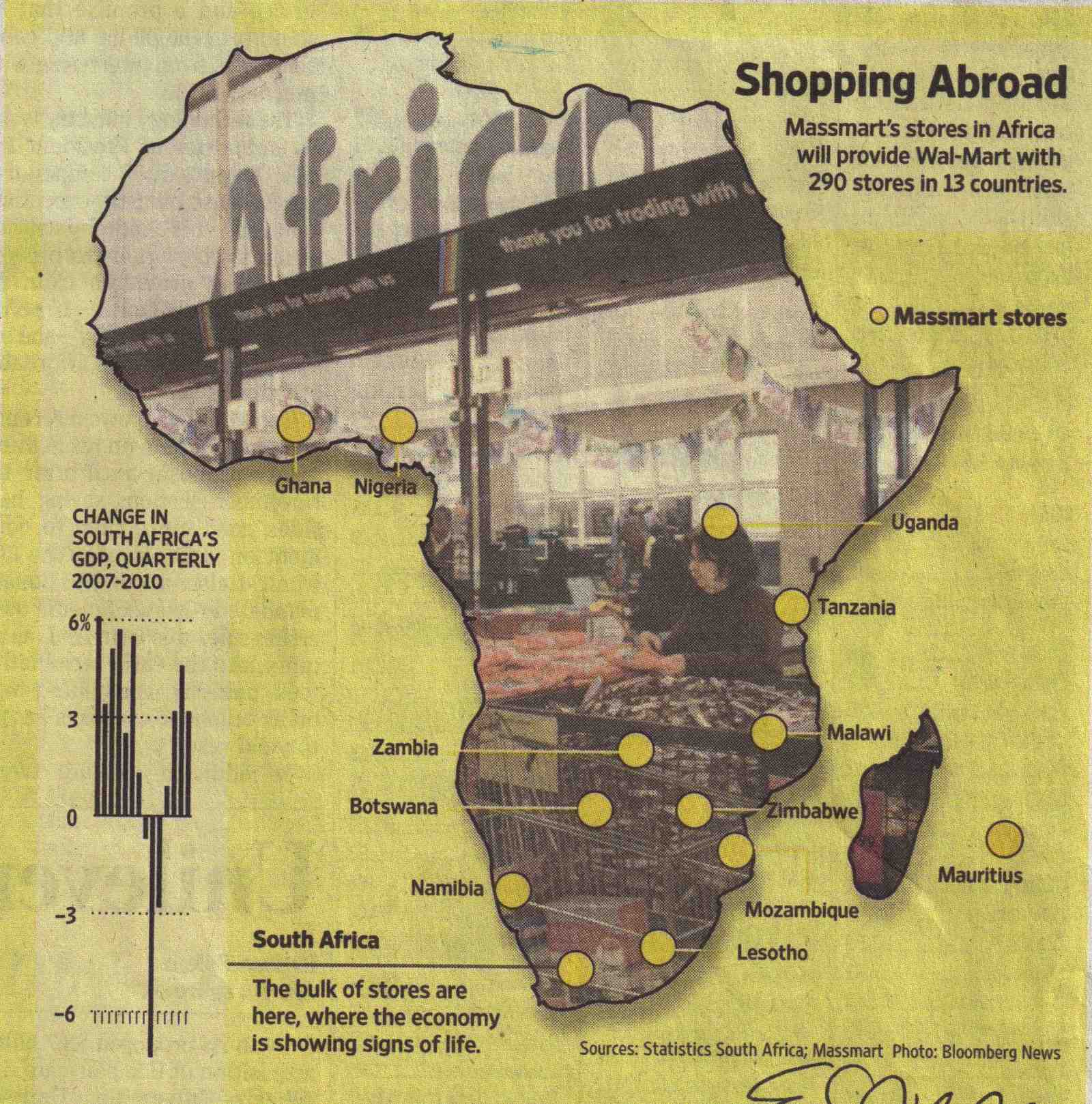

Wal-Mart bids $4.6B for Massmart Stores chain, a South African company. The offer, if it goes through, would give Wal-Mart an instant presence of 290 stores in 13 countries.

The offer is a good one--almost too high for the industry, indicating Wal-Mart's sense of urgency. As the WSJ piece declares, it's an "aggressive and expensive bid to expand in Africa ahead of its international competitors."

Unlike in booming Brazil, where Wal-Mart has spent plenty and still trails Carrefour in sales share, the company is looking to springboard ahead in Africa. Carrefour also holds the top international retail spot in China. Clearly, Africa is a riskier bet/environment than either of those too, but with consumer spending in the trillion dollar range (aggregate), the continent is hard to ignore.

Emerging/overseas markets now make up one quarter of Wal-Mart's $400B-plus annual revenue, and it is clearly the growth engine in the company. Wal-Mart is said to be examining Russia and the Middle East as well.

Places where this strategy of buying a local chain have failed for Wal-Mart tend to be more established markets--to wit, Germany and South Korea.

But when it comes to sub-Saharan Africa, the clear choice is to buy South African chains. They draw neighboring states' consumers and typically reach back into those same states with satellite stores.

Wal-Mart is paying 13 times pre-tax earnings, which is a nice price for most industries but particularly good for a retail player in developing markets.

As usual, Wal-Mart's entry is expected to shake up the existing grocery oligopoly.

You want an example of how the Gap gets shrunk? It doesn't much better than this.