Ag "wars"! (fought with money and lawyers--damn it all!)

Wednesday, September 8, 2010 at 12:05AM

Wednesday, September 8, 2010 at 12:05AM  Target acquired!

Target acquired!

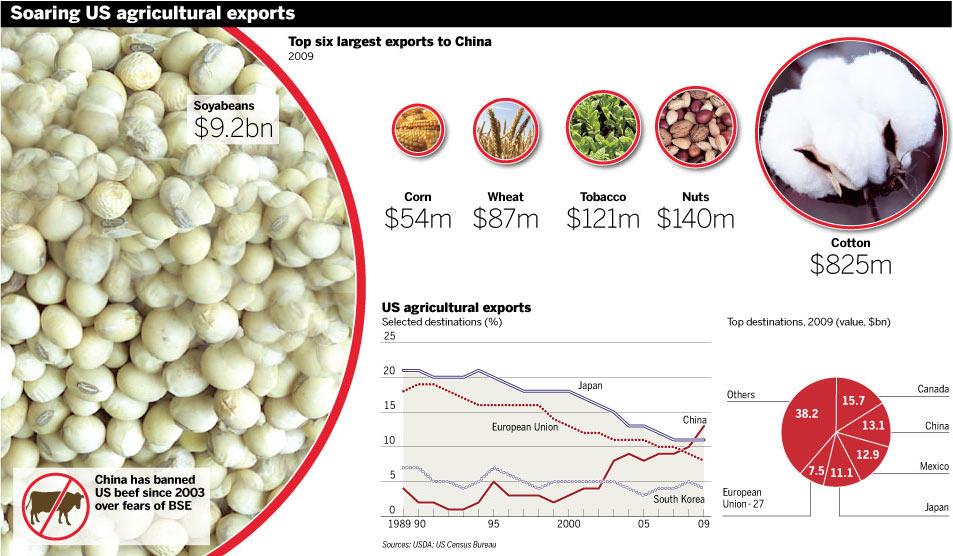

FT full-page analysis on how economic (more calories) and demographic (more mouths) pressure on ag production is leading to an M&A fight over PotashCorp--the fertilizer giant. The UN now predicts a 70% increase in food consumption by 2050.

Mining giant BHP Billiton is making a hostile bid for the Canadian firm, prompting talk of a counterbid by a Chinese national company, presumably because China fears a loss of access down the road. The fertilzer industry in general is experiencing heightened mergers and acquisitions deals (like the expected merger of two giant Russian fertilizer firms). Potash, a key fertilizer component, has seen its per ton price rise from $150 to $1,100 over the past half-decade, leading more nations to view the drab component as being on par with oil--a as in, a strategic asset.

Another example of how China's appetites and resulting connectivity are racing ahead of its political-military ability to defend them. Some look at that and see the rise of Chinese military power as the solution, but as I've explained many times, I don't think the Chinese political system could withstand an aggressive era of overseas wars--even to protect "vital interests." That vision just doesn't jibe with a nation of only-child "little emperors."

Alternative? China better have a lot of military allies around the world to help it deal with the fact that it's becoming the more resource-dependent--and thus vulnerable--economy in the world.