Director's Commentary On Chapter Four: The Economic Realignment: Racing To The Bottom Of The Pyramid

Saturday, January 31, 2009 at 3:40AM

Saturday, January 31, 2009 at 3:40AM There was no question in my mind that the realignment chapters would start with economics. This goes back with me all the way to the original Brief (looking at alternative global futures in the 1995-96 timeframe) where I did the six-lenses (econ, pol, tech, soc, enviro, sec). You always start with the economics when you're a determinist like me (the one part of Marx I still like).

The title is clearly a take on C.K. Prahalad's very cool book, The Fortune at the Bottom of the Pyramid. He and I gave dueling briefs at a Highlands Forum (special floating think tank community that convenes several times a year to look at issues for a senior defense office) that wanted to examine the SysAdmin concept (back when DoD 3000 was taking shape and new hires to that policy office were given PNM as source reading). C.K. and I bonded immediately. He told me that PNM was the pol-mil book he would have written if he had gone in the field, and I basically told him the same about his book and development economics, so we were like blood brothers on the spot. I felt the same way when I finally met Martin Wolf in Australia at the regional Davos meet. It's just that cool clicking together that some people get to enjoy. Plus, both C.K. and Martin are just such cool, fun, friendly guys that it's just neat to hang around them for a bit and be able to say you know them.

Clearly, C.K.'s book makes the counter-intuitive--a la DeSoto--argument that there's far more wealth down there at the bottom of the pyramid than we give it credit for. What I wanted to do here was combine the negative notion of "racing to the bottom" with his fortune found there at the "bottom of the pyramid," so the mesh became "racing to the bottom of the pyramid."

I wanted that focus because I wanted the chapter to highlight the emergence of a global middle class--a big sub-theme of the book. Yes, there was the temptation to recast everything in light of the financial crisis, but since I had written a column on the crisis way back in August 2007 and then again in Feb 2008, I felt like my take on America as "insolvent Leviathan" (subheader from the diplomatic realignment chapter) was already woven into the book's logic. Plus, I didn't want the book to seem too "now" focused--as in, on the crisis right now, because that's so non-strategic and there's nothing that embarrasses me more than dated material when you look at the book 2-3 years hence.

No, I was certain even after the Oct 08 collapse that I wanted the long-term focus of this chapter to remain on the emerging global middle class--this century's most powerful economic "great power."

Page tripping:

(160)

The "demand center" concept was something I learned from the guys at Cantor Fitzgerald. They really did start me down the path of recognizing that demand equals power in globalization far more than supply, because without demand, there is no market. Analogizing demand centers to the Boomer generation is easy. Everyone has witnessed that in terms of consumer fads.

(161)

The funky countries-as-states map of the U.S. that I blogged long ago is used here as the introductory concept for the chapter. I have a cool slide on that now in the brief, where I note that the populations of all those countries collectively surpass 2 billion, while these United States make all that GDP happen on a base of only 300m--almost one-seventh. The point is, we had to develop a lot of rules to make all that transaction stuff happen.

(162)

Another mini-thesis expression in the book: globalization integrates trade by disintegrating production chains. It happened in America in the latter half of the 19th century when we left the "olive tree" and moved into "Lexus"-land. Now it happens globally as our American System-cum-globalization reaches its worldwide apogee.

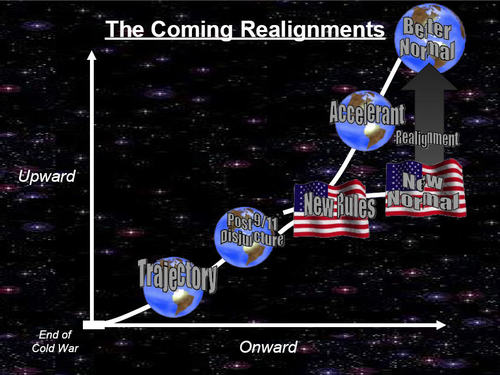

Here I do an intro of the 7-stage model around which I organize the realignment chapters. I did this up as a brief for one and only one time: Pop!Tech 2007 in Maine, in a special side talk that took place at a hotel.

(163-64)

The seven-stage model begins with the undeniable strategic trajectory that the world was on until America's global system was perturbed, resulting in the new rules that emerge and the resulting "new normal." Meanwhile, the global accelerant . . . only picks up speed, causing a divergence between our path and the world's, necessitating our inescapable realignment in the direction of the better normal America must seek.

This model began as part of my generic thinking on any crisis, and was applied first in my work on Y2K and then 9/11 with Art Cebrowski. I distinctly remember the first time I ran Art through the model at the Office of Force Transformation offices in Rosslyn. The slide above is basically the same one I showed Art, with a few minor changes.

THE UNDENIABLE TRAJECTORY: DENG CHOSE WISELY

The tagline here was inspired by that old knight at the end of the third Indiana Jones movie who, when Indy asked about the dead guy in the corner, replied, "He chose unwisely." I always loved that line.

Anyone who's followed my work knows how impressed I am by Deng's legacy of world-changing decisions.

(165)

My comparison of Deng to Alexander Hamilton, linking his struggle with Chen Yun to Hamilton's struggle with Thomas Jefferson.

I repeat the 90/10 bit about Tiananmen from PNM. It just fit again.

(166)

Deng's "grand compromise" at the 14th Party Congress: see, China's got one too! Marti's book on Deng was invaluable in this analysis. Another Vonne find.

(167)

China's westward integration process today compared to America's in the 19th century

THE AMERICAN SYSTEM PERTURBED: 3 BILLION NEW CAPITALISTS REGISTER THEIR DEMAND

The "3 Billion" bit comes from Clyde Prestowitz, whose book I cite earlier in the text. I met him in Australia at the Davos regional meet too, and I found him a fairly prickly porcupine. Smart guy, but very sarcastic and cynical. I seemed like an innocent angel next to him on the two panels we shared.

(168)

Comparing the American and current globalization periods, a line I love is, "So many Deadwoods, so little time." I love that construction so much I am in danger of overusing it in the manner of an "X worth X-ing."

The hi-lo-no trust environments bit is found here. It generates a great slide in the brief, one that never fails to generate discussion and response.

I like the bit about China merely consolidating the assembling-point flow of East Asia's already big trade surplus with America.

(169)

Key factoid: Taiwan controls about 70% of China's exports in high-end electronics.

The "welcome to The Jungle" bit taps two sources: Upton Sinclair and Guns 'n Roses.

Some repurposing of the column on how China learns from product scandals.

(170)

Some inevitable stats on China's consumption of raw materials. I tried to avoid making any big data dumps in this book--too academic.

(172)

I like the China = Hamilton and India = Jefferson bit. Probably not original, although I don't remember ever reading it. Really a simple observation once you realize India's "village ideal" and China's not giving a rat's ass about their own in their rush to industrialization.

I used to have this very lengthy (as in, 25-slide) sequence of China's landmass (often split into various kingdoms) as it evolved over thousands of years of history (making 200-year leaps with each slide). I had it all timed and would just let it rip to show kids (I gave this brief to my kids' classes) how China had often come apart during peace and integrated only during war, but also that China never really conquered much of anything beyond its current borders throughout its entire history.

So yes, I am aware of China's long history, and yet, the people who agree most with my statement that China is only 30 years old (dating back to Deng's initiation of reforms in 1979) are Chinese academics (meaning academics in China)

(173-74)

I do the China "time machine" slide outlining a concept that's morphed over time for me from its first thumbnail sketch in BFA, then expanded on a slide I still use in the brief, then expanded further in a column I wrote, and now expanded even more in this rendition. Quite the polished stone.

Why repurpose here? I often ran into the question of whether I might take something from the non-widely-read BFA and expand here to make this book be all that it could be, and when I did, I usually chose to reuse and expand. Because good stuff bears repeating.

(175-77)

THE NEW RULES: CHINA BREAKS THE MOLD OR MERELY RECASTS IT?

This section is based on the Baumol et al. book, Good Capitalism, Bad Capitalism, which I highly recommend. The first version of this section was pretty long, and I went whole-hog on the book and gave all sorts of additional reasoning and even a model of sorts regarding evolution of economies.

Then Mark cut the entire frickin' section in his first big edit. I was like, "Dude, we can't have a 6-part model in only this one chapter. I need something here!"

Well, by then I had done a dramatically slimmed down version as a nice column, and when presented with that, Mark's criticism melted away. In truth, I did go on way too much on the economic models here, so better to use this more polished, Reader's Digest version. Note that this section is probably the shortest section in any of the realignment chapters.

I do this section up now as a fairly simple slide, but have a very nifty, complex one in the works, one that I drew on the inside cover of the book as I read it. It may be a great slide or it may suffer the same drill-down feel that my first version of this section had. I will try it someday, though, when I find the time.

(177)

THE NEW NORMAL: DEFAULTING TO THE BEIJING CONSENSUS

I thought the wordplay here was also neat in a financial sense (like defaulting on loans or debt), especially when linked to China.

I definitely get off on a rant against neo-Marxism here, but it truly represents my passionate rejection of that bullshit analysis. I got fed all manner of this junk in college in the early 1980s. It sucked then and it sucks now. And I especially like sticking it to this crowd during the current financial crisis, because it's one thing to be a fan of capitalism when it hums along and another thing to keep believing in it when it screws up royally. Yes, this ninnies have their moment now, but that's all it is.

(177-187)

This is the section where I deal most directly with the current financial crisis. As such, it was the section of the book most edited at the last minute. Still, other than a couple of paras inserted, I mostly added parenthetical statements to show awareness while not making it the basis of the chapter's argument, which--again--would have been too current event-ish for my taste as a grand strategist.

(179)

The bit about "You'll get your paycheck" comes from real experience as an entrepreneur alongside Steve DeAngelis at Enterra. We've never missed a payroll, no matter who had to pay up!

(180-81)

Long bit that repurposes some material from past columns on sovereign wealth funds and FDI in the Middle East

(183)

A favorite sentence: "Frankly, we all knew we were living beyond our collective means these past few years, and deep down, we were hoping somebody would apply some discipline to this unsustainable dynamic." I wrote that in February 2008. So when I get the "I told you so" emails from economic hysterics, I am not amused with this prescience in predicting the Oct 08 meltdown. I certainly was clued in. I just was ambivalent about the exact timing, as I don't think of grand strategy as futurism or pinpoint predictions.

(184-85)

The Washington Consensus as the logical code of a mature market economy, but the Beijing Consensus as the logical code of a rising one--including America from its birth until a decade or two into the 20th century!

(187)

THE GLOBAL ACCELERANT: RUSHING TO SETTLE FRONTIERS

Starts with the globalization-replication slide I still use in the brief.

(188)

The peace dividend/grand strategic argument that now serves as the opening section of my brief.

(190)

China gets old before it gets rich.

(192)

China foreign ministry story comes from a buddy of mine who was high up in State in the second Bush term.

(192-196)

Inevitable chunk on official developmental aid. Boring to some, but I felt like I needed a discussion somewhere on Collier, Sachs and Easterly, the holy trinity in the field right now.

(195-96)

Bit I've long done in the brief: plop a Western businessman in Africa and all he sees are bad conditions, but do the same with an Indian or Chinese and they see a landscape very familiar and thus very workable.

(196)

THE INESCAPABLE REALIGNMENT: REMAPPING FAKE STATES

Could have done some bit here on a new global financial order, but I wanted to keep the book/chapter more focused on the Gap

(197)

Paul Collier's stuff really is brilliant. His Bottom Billion deserved every award it got.

Favorite bit extrapolated by me: only 1% of Core features landlocked, resource-deprived countries, but one-third of Africa suffers this postcolonial fate.

(197-98)

Easterly's stuff on squiggly lines is also brilliant. He and Collier are my two favorite economists.

(199)

Only second time in three books do I describe a slide so overtly. It is my favorite current slide, though.

(200)

Killer line for me: "... because everything I needed to know about globalization I learned in American history." I liked how that line appears here versus the history chapter.

(201)

I thought the three takeaways here were great: they just popped into my head as I sought to wrap up the section.

(202)

THE BETTER NORMAL: RACING TO THE BOTTOM OF THE PYRAMID

(202-04)

My ode to Prahalad.

(205-06)

Bit on Africa, leveraging the World Bank report. I wrote that in, and then later repurposed as tighter column. Mark cut the original out completely, but like before, I talked him into putting back at least the tighter, column version. So the columns saved two chunks of this chapter.

(206)

Spot the evolution of the message: "leave the place more connected than you found it" (PNM), "because jobs are the only exit strategy" (BFA), yielding chapter-ending line in GP that states, "If you really want to win this long war, then do whatever it takes to make globalization go faster."

There's the entire trilogy in miniature.

Reader Comments (2)

Bottom of the pyramid has often caused misperception when it can't be measured in money. Early American colonists had sufficient land, decent homes, and adequate locally produced quality food and clothing. They felt poor because they had little or no money to pay things like stamp taxes, or consumer products from England. When the English sent paid draftee and mercenary troops to help colonists fight French they were amazed at the colonists' material and lifestyle wealth. The colonists in turn were impressed that the grunt soldiers seemed to have so much 'scarce' money.