Samuelson in WAPO by way of David Emery.

Samuelson in WAPO by way of David Emery.

NIEO refers to the notion, championed by the South in the early 1970s, of a more equitable global economy (New International Economic Order).

Well, guess who made it happen? Not the Sovs, and not the South, but the New Deal for the World-cum-post WWII order-cum-the West-cum- the global economy-cum-globalization, dreamt up by the United States (TR), launched by the US (FDR), defended and expanded by a series of presidents (Nixon getting the most credit, in my mind, because he opens up China and caps the Sov threat), and finally now rebalanced by our own success--and excess--in that quest.

The two biggest players in triggering this latest rapid expansion of globalization: China and India, with Brazil, Turkey, South Africa moving up fast.

According to Subramanian (often in FT) by way of Samuelson, another take on the journey from the Gap to the Core:

This is classic economic catch-up, as poor countries adopt the products and technologies of rich countries. It's a two-step process, says economist Arvind Subramanian of the Peterson Institute. "First, countries have to cross the Hobbesian threshold" -- that's after philosopher Thomas Hobbes (1588-1679), who declared that life without strong government is "nasty, brutish, and short." Governments must provide basic security and sanitation, create some rule of law and establish protections for property, says Subramanian. Otherwise, the stability doesn't exist to pursue Step Two: allowing markets to work; practicing standard economic virtues (taming inflation, disciplining government budgets).

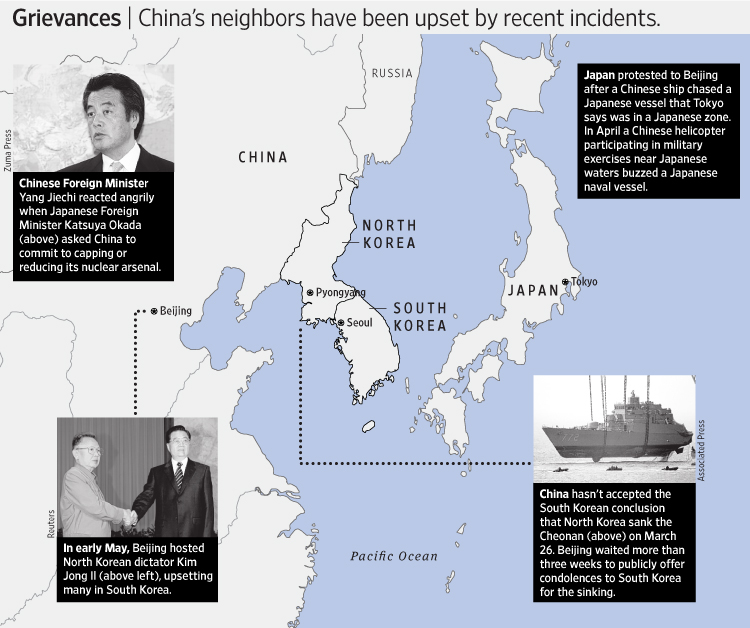

Parts of Africa and Latin America still haven't crossed the Hobbesian threshold, says Subramanian. But elsewhere, many countries have reaped the rewards of moving to Step Two. China and India are the most spectacular cases. Only in recent decades have they relaxed pervasive state regulation and ownership and trade restrictions for more market-based policies.

Now Samuelson's judgment on what must come next:

So is rebalancing going according to script? Well, not necessarily. It's true that the massive trade imbalances have dropped sharply. The U.S. trade deficit fell from $760 billion in 2006 to $379 billion in 2009; China's trade surplus also dropped. But these changes mostly reflect the Great Recession. The worsening slump caused people and companies to stop spending. Global trade contracted sharply -- and with it the size of imbalances. But as the recovery has strengthened, trade and imbalances are growing again. American imports are increasing faster than exports; this surge could be temporary, suggests economist Richard Berner of Morgan Stanley, as companies replenish depleted inventories.

Still, what's missing is a sizable revaluation of China's currency, the renminbi. Fred Bergsten of the Peterson Institute thinks the renminbi may be 40 percent undervalued against the dollar. This gives China's exports a huge advantage and underpins its trade surpluses. Other Asian countries fear altering their currencies if China doesn't change first. "They'll lose ground to China," notes Hensley. The European Union, Brazil and India all feel threatened by the renminbi. President Obama wants U.S. exports to double in five years. That's probably unrealistic, but it's impossible if the renminbi isn't revalued.

The next best problem to have, no doubt, and I agree with those that say "paid in renminbi" will be the slow route by which China converts its currency (letting more and more of its importers use the yuan, swapped out by China via currency trades). But as this process matures, it will represent a brave new world for the Chinese as much--or more--than for the US and its dollar.

In short, the catch-up strategy stuff ends and the competition gets a whole lot more real.

Wednesday, June 9, 2010 at 12:09AM

Wednesday, June 9, 2010 at 12:09AM