12:05AM

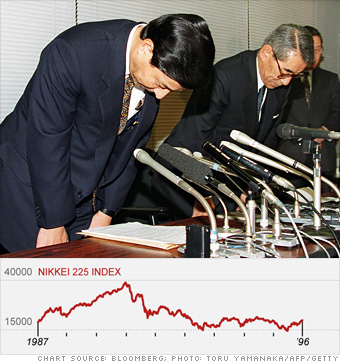

Krugman: our fear of deficits may doom us to a Japanese-style "lost decade"

Saturday, May 29, 2010 at 12:05AM

Saturday, May 29, 2010 at 12:05AM Krugman argues against our popular instinct not to see our government get insanely in debt, saying:

But the truth is that policy makers aren’t doing too much; they’re doing too little. Recent data don’t suggest that America is heading for a Greece-style collapse of investor confidence. Instead, they suggest that we may be heading for a Japan-style lost decade, trapped in a prolonged era of high unemployment and slow growth.

But the truth is that policy makers aren’t doing too much; they’re doing too little. Recent data don’t suggest that America is heading for a Greece-style collapse of investor confidence. Instead, they suggest that we may be heading for a Japan-style lost decade, trapped in a prolonged era of high unemployment and slow growth.

If that isn't a vigorous enough statement, consider this:

I strongly suspect that some officials at the Fed see the Japan parallels all too clearly and wish they could do more to support the economy. But in practice it’s all they can do to contain the tightening impulses of their colleagues, who (like central bankers in the 1930s) remain desperately afraid of inflation despite the absence of any evidence of rising prices. I also suspect that Obama administration economists would very much like to see another stimulus plan. But they know that such a plan would have no chance of getting through a Congress that has been spooked by the deficit hawks.In short, fear of imaginary threats has prevented any effective response to the real danger facing our economy.

I will admit: as much as this scenario scares me, I am still more scared by the crowding-out phenomenon associated with that massive federal debt. I sense that we'd be better off facing tough challenges in the shorter-run than assuming recovery of government revenues for a long-enough stretch to make good on all this debt. That just strikes me as too optimistic, given our demographics and love of medical technology and our enduring commitment to fielding a large military--all of which will have to give. I also agree with Krugman's suspicion that more stimulus is a political non-starter.

Reader Comments (2)

As long as Congress continues to kick the can down the road in regards to entitlements and continues to pass "reform" bills that do little if any reforming like the health care bill (expands coverage but does little to incentivize efficiency) or the more recent financial reform bill (continues to incentivize gambling and the continued accumulation of the nations assets by a handful of banks setting up for the next big bailout as opposed to investment in new businesses) then we are looking at not just a lost decade going forward but a continuation of the losses of the past ten years. I look at my 401k and 529 statements and the balances are mostly my contributions.

Krugman might have been a coherent economist once upon a time, but he's long since lost his touch. While he might be right about the results of austerity measures leading to a "lost-decade", that he sees a choice here, speaks more to his political leanings than his mathematical skills.

http://www.minyanville.com/businessmarkets/articles/public-debt-goldman-sachs-short-selling/5/3/2010/id/28074?page=full

Here's a pretty good article about the future of public debt across the OECD, based on a paper put together by the Bank of International Settlements.