WSJ story on how Asia's food demand continues to rise while the amount of land devoted to food production is pretty much capped this decade due to urbanization and planned investments just aren't happening as envisioned (so yield per acre not rising enough to cover the delta in demand).

WSJ story on how Asia's food demand continues to rise while the amount of land devoted to food production is pretty much capped this decade due to urbanization and planned investments just aren't happening as envisioned (so yield per acre not rising enough to cover the delta in demand).

The plan was to dramatically boost farm investment in Asia's developing countries after the scary price spikes in 2007-08, which may be remembered in the same way as the original OPEC price spikes of the early and late 1970s--a harbinger of a permanently tight market where any de-synching of demand and supply leads to real and perceived crises of the highest order (as in, governments fear for their regime stability).

Examples of the investment: opening up land previously considered marginal and improving farm-to-processor infrastructure (mostly roads and storage facilities). The big hold-up, unsurprisingly, is the financial crisis. Then there's the usual uncertainty on land ownership and fears of environmental ruin.

Why things won't get so bad globally this time around: grain stores are up and the economy is weaker, but these are temporary conditions that do not obviate the strong underlying trends. As one researcher on rice puts it in the piece, "2008 was not just a blip, this is the way things will be, with repeated shocks."

The financial crisis, in my mind, caught Asia about a decade too early--not enough rules and not enough positive evolution on politics (especially the talent level of leadership) and not enough development of financial markets (in terms of being more fluid and responsive). Asia in general is still burdened by rules and leadership and mindsets better attuned to extensive growth (throw in more stuff!) and the ag scene calls for intensive-growth answers (much higher yields on same amount of land). The Philippines, as the piece notes, produced 92% of its rice in 2000, but is already down below 80% today. That gap will only grow, because most dreams of getting access to unused land won't come true (the urbanization going on is likewise intense) and even if access is had, yields won't be so high without serious investment.

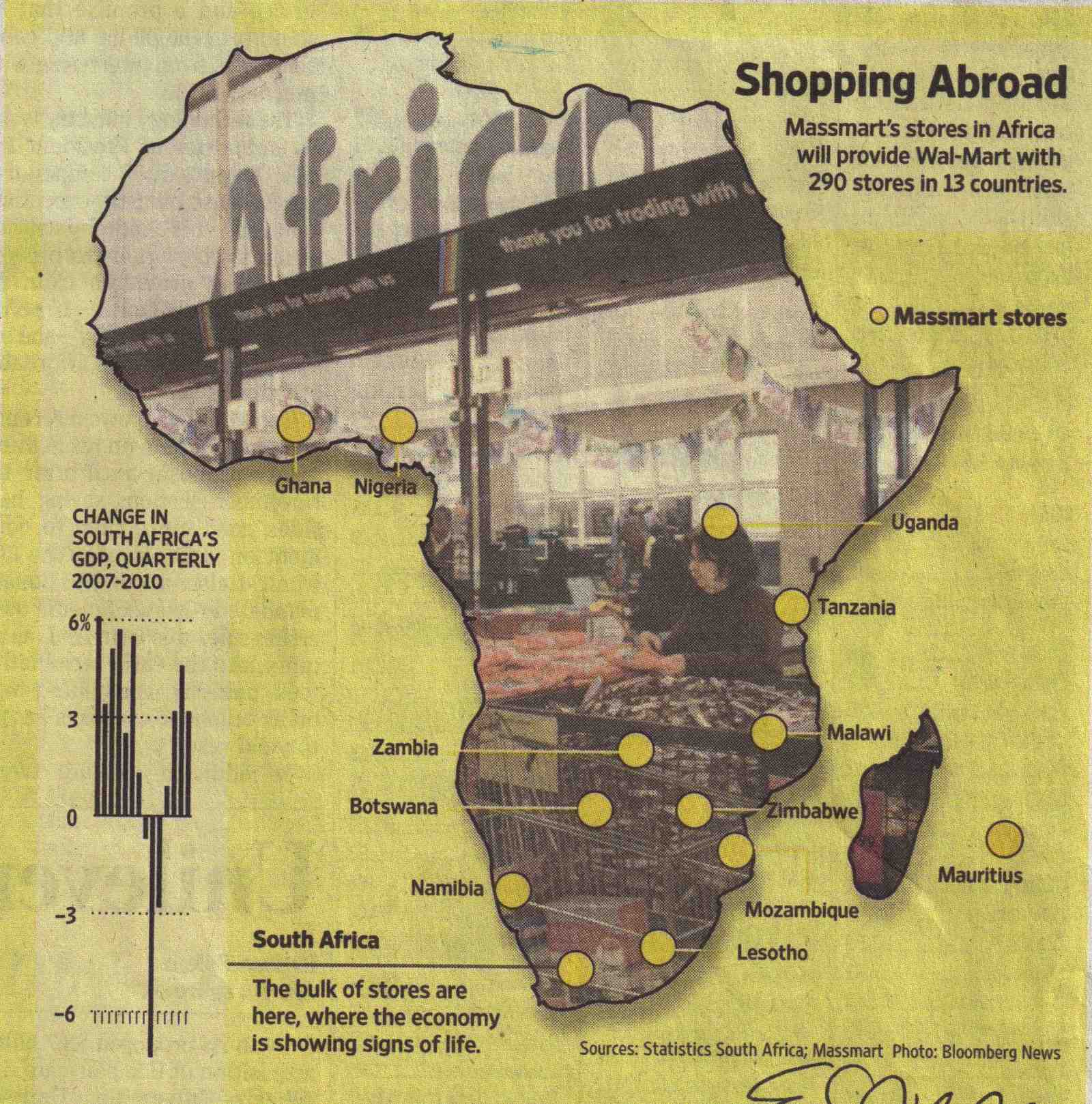

In the end, all the brave talk about food self-sufficiency in Asia is just nonsense; ain't never gonna happen. But Asia certainly could do better, so that the demand doesn't outstrip local supply too intensely too fast. We've seen more than a few Asian states move into that outsourcing trend of renting or buying up nice farmland overseas (in Africa, for example), but that only buys you a whole new load of responsibilities that I think a lot of these countries--especially China--are ill-prepared to follow through on.

I remember driving from Addis Ababa down to Awassa in southern Ethiopia and seeing huge chunks of the best farmland sort of tarp'd off--as in, covered on all sides and seemingly roofed with simple metal skeletons wrapped in this thin but opaque poly skin (I assumed the topsides where clear enough to let in the bulk of the sunlight). It was a stunning sight to behold: all this open, rich farmland still operated in very early 20th century terms and then these huge, fenced off and covered up tracts where--apparently--a whole new level of effort was being made. Unsurprisingly, I saw labor barracks nearby with a Chinese flag flying out front.

Now, you can say, this all works so long as the local government makes it work, but if a food crisis really comes along and the local population is suffering in a way that's undeniable in terms of global news coverage, then that thin poly cover-up won't be enough to keep that food production secret and safe. And China will find itself unusually responsible for what comes next in places like Ethiopia.

And that's when the whole "non-interference" things gets revealed as so much empty talk. There is no way China rises and becomes what it is becoming without have huge interfering effect all over the planet, and people will hold it responsible for all that change--both the good and bad.

Don't get me wrong: I think China's impact will be overwhelmingly positive overall, as the sustained demand for resources does plenty to jump start and fuel development in places like Africa in ways that the boom-and-bust cycle previously offered by the West did not. But with the good will come the bad, and that means China gets dragged into all sorts of uncomfortable dynamics it has previously sought to avoid.

This is why I argue that serious strategic partnership with the U.S. is hardly just in America's short- and medium-term interest (due to its current straining to meet its global security obligations). Over the long term, it's far more in China's interest. Back in "Blueprint," I said America needed to "lock in China at today's prices," but the obverse is equally true now: prices will never be lower and China will never find a more pragmatic leader than Obama, because if he loses in 2012, expect the usual "apres moi, le deluge!" reactions to kick in.

This is another example of why I think the 2010s are a turning-point decade--as in, get it right and globalization's future is secured, but screw it up, and far different global pathways are made possible. Inside all those dynamics, the US-Chinese relationship is the long pole in the tent: get it right and nothing can go wrong, but get it wrong and nothing will likely go right. Why? The rise of the global middle class means there will be so little slack in so many systems, that it'll feel like we're collectively in constant crisis. This environment yields the "keeping all the balls in the air" mindset currently on display at State with Clinton (who needs to aspire to higher goals than just this). The same is unfortunately true in Beijing. All this kicking-the-cans-down-the-road lack-of-ambition serves the world poorly at this moment of great structural change: everybody of note seems to avoid leadership.

But there's no question about China becoming far more of a global leader; it has no choice. The question is how much of this leadership emerges pro-actively from Beijing, and how much is teeth-pulling from the rest of the world.

China's JFK is yet to emerge, but he was one of the "heroes of the future" I cited at the end of "Blueprint for Action": the leader who steps up and asks China to think less of what the world owes it (after all those decades of "humiliation" and the long slow climb back up from widespread poverty) and more about what China owes the world. That moment/leader will be a defining dynamic for the 21st century and how the world evolves.

And food is more likely to drive that process than energy or anything else.

Tuesday, November 27, 2012 at 11:07AM

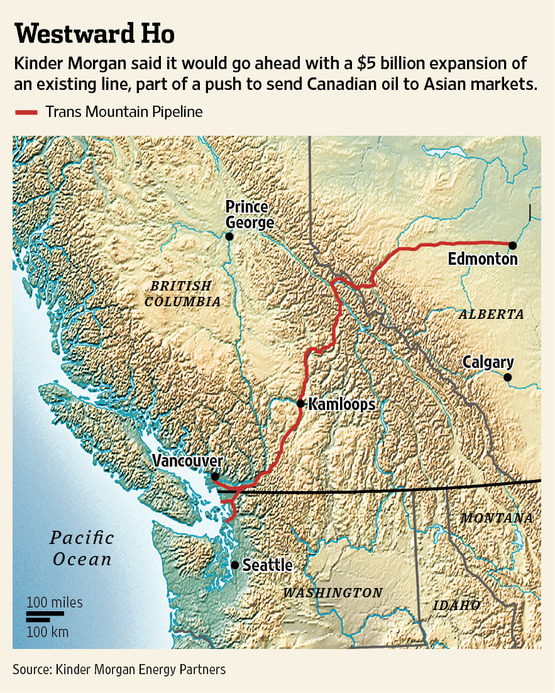

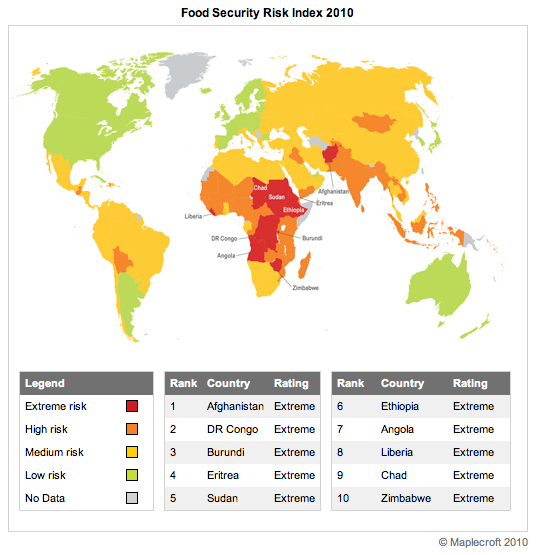

Tuesday, November 27, 2012 at 11:07AM  Notice the equatorially-centric band? Remind you of another map?

Notice the equatorially-centric band? Remind you of another map?