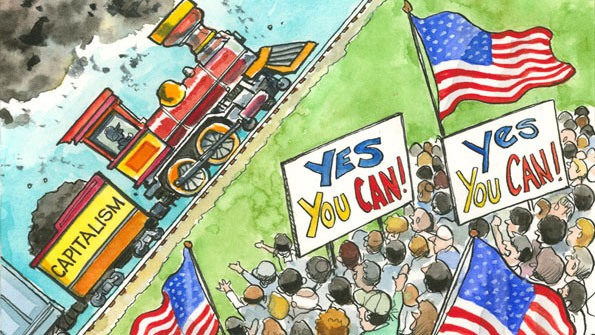

The jobs-creation killer that is high corporate taxes

Thursday, July 15, 2010 at 12:09AM

Thursday, July 15, 2010 at 12:09AM

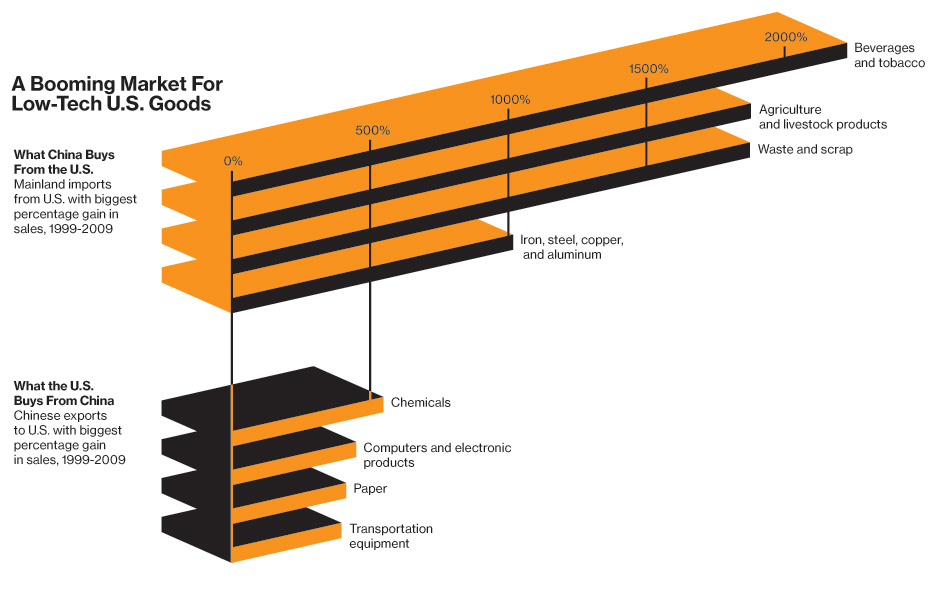

WSJ op-ed by Laura D’Andrea Tyson and others lamenting the US’s relatively high corporate tax rates and its effect on dampening job creation here.

Gist:

All of the business leaders interviewed for this study agreed that U.S. tax policy has a “major impact” on their competitiveness and investment decisions, and most said that policies like limits on skilled immigration handicap their companies. In the words of one executive, tax considerations are “often one of the largest line items in the investment projection.” Moreover, many of these leaders voiced concern about the future ability of this country to attract and grow corporate investment, R&D and jobs. U.S. multinationals will not aggressively invest and hire here at home if they can’t realize attractive returns from doing so.

Depressing stuff, given the anti-business mood in Washington.