WAPO story detailing the "genius" that is economic planning in the obviously superior Chinese economic model.

WAPO story detailing the "genius" that is economic planning in the obviously superior Chinese economic model.

Unlike in the United States -- where President Obama's large stimulus plan became the subject of protracted congressional wrangling and was shaped to include tax cuts and aid to states -- Chinese leaders followed a simple mandate: Spend and build.

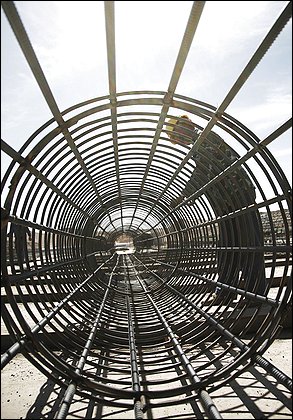

Forget the tax cuts; in China, it was infrastructure, infrastructure and more infrastructure.

China was already awash in big-ticket construction projects. The stimulus allowed China to speed up some projects, begin digging on others and extend the building boom to less-developed areas in the country's west and north. The result, 18 months after the stimulus was introduced, is an astonishing frenzy of building -- highways, subways, airports, bridges, high-speed rail lines and even new cities constructed, literally, in the middle of nowhere.

Hmmm. Impressive.

Now the truly scary parts. First, what do we know of these economic "geniuses"?

Several economists said it was difficult to determine the worth of all the spending because there is no official, centralized list of projects -- making it difficult to untangle whether projects are funded from stimulus loans, from local governments floating bonds or from some combination of the two.

"It's a black box financed by black laws," said Xu Xiaonian, an economics professor with the China Europe International Business School. "There's not enough information to make any sensible judgment."

Second, our stimulus was set up by federal spending. In China, cities and provinces aren't allowed to take out loans like that, so they set up dummy investment entities that assume the loans. The result, despite this infinite cleverness (indeed, is it not a NEW ECONOMIC MODEL?):

As a result, economists said, local governments are now sitting on a total potential debt bomb of 7 trillion to 11 trillion yuan.

"There's tens, or hundreds, of Dubais waiting in the pipeline," said Xu, referring to the debt-laden Persian Gulf emirate. "It was a panicked reaction to the global crisis. So they rushed out to spend money wherever they could. They borrowed from me -- and from every Chinese." He added another ancient proverb: "You eat your dinner at noon, you have to starve at night."

No question the stimulus worked both here and there, but the price tags are similar--as is the Keynesian "genius."

Ain't no such thing as a free lunch, I believe Prof. Xu said.