Funniest SNL video ever (for me, at least)

Sunday, November 18, 2012 at 7:20PM

Sunday, November 18, 2012 at 7:20PM Painfully true, like I wrote this!

Sunday, November 18, 2012 at 7:20PM

Sunday, November 18, 2012 at 7:20PM Painfully true, like I wrote this!

Friday, November 16, 2012 at 11:11AM

Friday, November 16, 2012 at 11:11AM Title of the WSJ's lead editorial on Tuesday.

Two charts displaying the tectonic shift afforded by fracking technology.

This, plus fiscal constraints, makes for a new definition of US superpower-dom.

Let the debate begin ...

Let the debate begin ...

Thursday, November 15, 2012 at 8:31AM

Thursday, November 15, 2012 at 8:31AM

Malaria still existed throughout much of the US in the 1930s/40s. Since then it has gotten much warmer throughout the US. But malaria is basically gone now. Why? Rising incomes.

So the point on global warming is, it'll create real problems wherever states and societies don't have the money to deal with the challenges - such as insect migration.

Now take a look at this chart from the WSJ and realize what happens when incomes fall - and how quickly.

Recently, Wikistrat ran a sim where we discussed the possibility of states making sovereign land sales. Several analysts said that, while that happened in previous centuries (note how most of America was acquired), nobody would consider that now.

My comeback was, if the financial situation gets bad enough, countries will sell just like people get rid of an underwater house.

Greece is looking pretty bad, and I think it's a harbinger of massive debt issues to come for a demographically aging West.

The discussion we had was about the Arctic and the possibility of some Arctic Council members selling out to non-members so as to tap the finance needed for exploitation of opportunities. After all, the US bought its seat at the table - aka, Alaska.

Wednesday, November 14, 2012 at 9:34AM

Wednesday, November 14, 2012 at 9:34AM

FT story on new Chinese estimate for natural gas ("far greater reserves . . . than previously thought") in South China Sea (roughly 500T cubic feet). Also 17B tonnes of oil.

Yes, those are both weird British measures.

But the accompanying reality:

Although only a fraction of those resources would be economically feasible to extract, analysts calculate that the levels of reserves could one day double China's current proven reserves in oil and gas.

Hmm. A doubling of reserves, but the new stuff is largely not worth extracting. I'll leave the glass-half-full/empty calculation to others.

Piece also quotes Hu Jintao on way out of power declaring that next generation of leaders must make China a "maritime power."

Okay.

But Wang Yilin, boss of CNOOC, while noting that Hu's words "showed the way," also said "the company wanted to 'lay aside disputes and develop [the South China Sea reserves] jointly' with international companies."

So there you have it: China is declared to be way behind as a maritime power, so it must build up those assets. Big reason is South China Sea and all those energy reserves, even if only a fraction will ever be pulled and that difficult feat requires lots of joint ventures with foreign energy firms.

Sounds like WWIII to me. Thank God for the AirSea Battle Concept, because we all know that sea control = seabed control (sort of). I foresee vast drone forces duking it out over a no-man's water. It'll cost several fortunes, but all those unfeasibly-accessed energy reserves will pay for it.

You have your orders.

Tuesday, November 13, 2012 at 8:56AM

Tuesday, November 13, 2012 at 8:56AM Shameless book plug here. I've known Tom Searcy for a while (see his interview of me here) and he's written a really cool book with Henry J. DeVries entitled, How to Close a Deal Like Warren Buffett: Lessons from the World's Greatest Dealmaker. I did an early review a while back and offered a blurb which appears in the front material and on the back cover. In full it reads:

Searcy and DeVries have made their own science of dissecting how persuasion leads to decisions leads to big deals. This book is Dale Carnegie reconfigured for the business world.

--Thomas Barnett, contributing editor of Esquire and author

of Great Powers: America and the World After Bush

The book's promo page is found here.

The book basically parses out Buffett's many maxims on how to conduct one's business life, with the proximate focus being which deals to pursue and close. But like any good book, this one actually speaks about a whole lot more than the subject material at hand. In sum, it has an almost spiritual feel, as it's as much a guide to a life well led as a deal well structured.

I do highly recommend it.

Monday, November 12, 2012 at 11:06AM

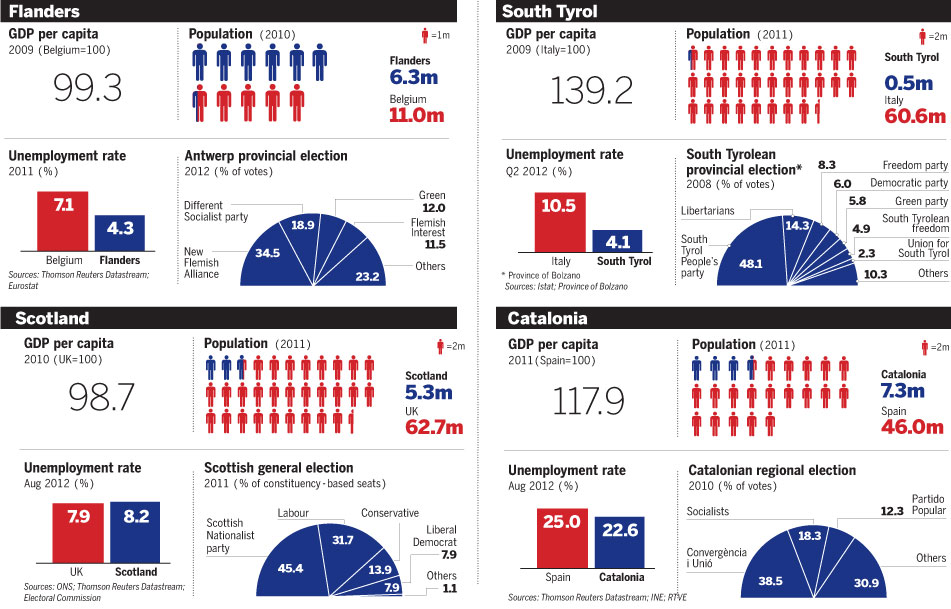

Monday, November 12, 2012 at 11:06AM Old argument of mine: globalization comes in and all manner of divorces ensue. Typically it's a fake state in the Gap that's coming apart at the artificial seams, but the larger point is, the more overarching multinationalism you have, the lower the cost of divorce/remapping. You're going to be together anyway (you still have the "kids" of the union), but why stay together if you don't have to?

Europe demonstrates this: the more integrated it becomes, the more states appear.

Great FT one-pager on "long-simmering separatist movements . . . gaining strength." You might think it's the Eurozone troubles that is responsible, but that's the proximate opportunity - not the ultimate enabler. Real federalism is coming, so why not get out of your unhappy marriage in the bargain?

Here's the counterintuitive part: it's often the most competent and richest that want out. The better want to leave behind the worse.

So this isn't about suffering. This is about ambition.

EU,

EU,  Europe,

Europe,  development,

development,  globalization | in

globalization | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Friday, November 9, 2012 at 10:19AM

Friday, November 9, 2012 at 10:19AM

FT op-ed certainly has me thinking.

Reality of a reserve currency: you need to be willing to leave large amounts of it lying beyond your shores. People need ready access to it. You can't be in a serious capital importing mode (which tends to happen when you grow).

So, most experts say, China can internationalize the use of the RMB but it won't be a real reserve currency because China won't allow large enough amounts to float around out there (Beijing wants tight control over value), plus, the country still needs to develop a vast impoverished interior of half-a-billion people, so it'll be in the capital-importing mode (trade surplus, investment) for a long time.

Makes sense.

But then Arvind Subramanian (smart guy on China) and Martin Kessler (I don't know) write this op-ed in the FT, pointing out that East Asia is "now a renminbi bloc because the currencies of seven out of the 10 countries in the region - including South Korea, Indonesia, Taiwan, Malaysia, Singapore and Thailand - track the renminbi more closely than the US dollar."

Same is becoming true for India, Chile, Israel, South Africa and Turkey. That's some real influence, ja?

In their minds, these are the "gravitational forces of economics" that China naturally exerts over major trading partners. No, China ain't big enough to do that to the dollar (would that it could so we might gain some discipline from somebody besides the more bankrupt EU), but already we see the emergence of a RMB East Asian monetary regime.

Again, nothing happens over night. But ask yourself: you think this is going to go away or get stronger over time?

If it's the latter, then we're looking at the future.

What this means for China, oddly enough: as it is forced into certain reforms, now it ends up having to take into account not just what happens inside China but across the implicit RMB monetary regime that is East Asia.

But the upside: "If China were to liberalise its financial and currency markets, the lure of the renminbi would broaden and quicken."

Old bit of mine: more you want to connect, the more you are subject to all manner of rules - and they come in so many forms and sizes, but they all constrain. Success is interdependent; failure is all your own.

Fascinating stuff.

Thursday, November 8, 2012 at 9:09AM

Thursday, November 8, 2012 at 9:09AM Nice NYT story on growth of (primarily) middle class resistance to unlimited growth ambitions WRT environmental damage. Most experts who track the grass-root democracy arising in China have noted its strong concentration in the environmental realm.

It's a natural development that we've seen everywhere else a middle class historically arises: once you get to a certain level of GDP ($4-7,000) you start caring about the environment a whole lot more.

Chart shows all the places where projects have been delayed/cancelled in response to popular demands.

Point being: all part of the natural slowdown in growth that comes with modernization. Things get more complex. The public puts up with less crap. China is not different in this regard whatsoever.

As I've noted for years now, Asian countries that modernize and open up to globalization typically do so as single-party states (either explicit or de facto) for about 5 decades. Then things change.

That logic says China goes democratic in the 2020s - or faster.

China,

China,  democracy,

democracy,  development,

development,  environment | in

environment | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article  Wednesday, November 7, 2012 at 9:42AM

Wednesday, November 7, 2012 at 9:42AM

Lost to Reagan twice and HW once.

Won twice with Clinton.

Lost twice with Bush.

Won twice with Obama.

Voted once in WI, twice in MA, once in MD, once in VA, twice in RI and twice now in IN.

What always gets me in the end? Supreme Court Justice picks. You don't think about it much on election day, but man, do you ever when somebody announces a retirement (or death). I just keep thinking about all those 5-4 decisions, like the recent one on the healthcare law (which I support).

Also this time: the sense that the GOP is losing its grip. Way too obstructionist over Obama's first term. Now polling lower than Independents, which stuns me. Losing women, which is a long-term issue of significance. Losing Hispanics, another long-term issue. The GOP is not a healthy lot, and their talent seems thinner than ever. it is becoming the party of scared white people in a multinational union experiencing unprecedented demographic change. That's not a winning proposition.

The Dems, meanwhile, have much better long-term prospects. Thus some genuine system utility in hopefully seeing the GOP realize how far they've drifted.

Yes, there will be many within the GOP that says "we lost because we nominated a moderate." But a hardliner would have done far worse, in my opinion - just driving up the Dem advantages on minorities and gender and sexual orientation (not a small percentage to ignore by any means). Simply put, that tent needs to be expanded because the GOP is running third right now.

And no, I don't think the GOP should draw much satisfaction from the popular vote. It's simply amazing that Obama won with the recovery coming so late. Six months from now he'd win by a much bigger margin.

Why do I worry about the GOP? In the end, they are more likely to be the agent of triggering a new progressive era (remember TR) than the Dems. I can see the Dems joining in with relish. I just suspect they won't have enough panic within their ranks to initiate.

So I'm hoping the GOP eventually locates that panic.

The clear pattern: states with borders largely go Dem and inland states overwhelmingly go Republican. It's just like China's emerging split and that of risers everywhere. States that face out versus states that face in. In the U.S., it's who's more open on immigration and less China-bashing versus who's tougher on immigration and more China-bashing. The GOP simply doesn't work as the party of fear.

Tuesday, November 6, 2012 at 9:08AM

Tuesday, November 6, 2012 at 9:08AM  Yes, a brain drain as reported in the NYT.

Yes, a brain drain as reported in the NYT.

At 30, Chen Kuo had what many Chinese dream of: her own apartment and a well-paying job at a multinational corporation. But in mid-October, Ms. Chen boarded a midnight flight for Australia to begin a new life with no sure prospects.

Like hundreds of thousands of Chinese who leave each year, she was driven by an overriding sense that she could do better outside China. Despite China’s tremendous economic successes in recent years, she was lured by Australia’s healthier environment, robust social services and the freedom to start a family in a country that guarantees religious freedoms.

“It’s very stressful in China — sometimes I was working 128 hours a week for my auditing company,” Ms. Chen said in her Beijing apartment a few hours before leaving. “And it will be easier raising my children as Christians abroad. It is more free in Australia.”

As China’s Communist Party prepares a momentous leadership change in early November, it is losing skilled professionals like Ms. Chen in record numbers. In 2010, the last year for which complete statistics are available, 508,000 Chinese left for the 34 developed countries that make up the Organization for Economic Cooperation and Development. That is a 45 percent increase over 2000.

Guess who wins this lottery, as usual?

Guess who wins this lottery, as usual?

When experts note that China modernized and marketized and opened-up to the world for the past 40 years and the Party still rules, they miss the reality of what happens when a critical mass middle class appears and starts wanting more than just a rising income.

That day has arrived.

So no, it's not a question of "Can China ever go democratic?" It's only a question of when.

There is nothing unique about Chinese or Asian civilization in this regard. Modernization is modernization. People are people. Democracy isn't achieved because it's fabulous. It happens because it's the best worst system you can manage when you reach the point of genuine development.

Monday, November 5, 2012 at 10:56AM

Monday, November 5, 2012 at 10:56AM

Wealthy Chinese citizens are moving their money abroad: "buying beachfront condos in Cyprus, paying big U.S. tuition bills for their children and stocking up on luxury goods in Singapore, frequently moving cash secretly through a flourishing network of money-transfer agents."

Last 12 months, estimates the WSJ, 3% of China's GDP slips overseas this way.

Two ways of looking at this:

Either way, not a good sign.

After all these years of do-nothing Hu, Xi is going to be under tremendous pressure to fix things.

Friday, November 2, 2012 at 8:49AM

Friday, November 2, 2012 at 8:49AM Pair of WSJ stories.

Front-pager lead from yesterday notes that "Election May Hinge On Latino Turnout." Get used to that headline, and get used to it working against the immigration-unfriendly GOP.

Obama is currently polling at 70% (Romney 25%) among the fastest growing segment of the electorate.

The key to Obama's win, we are told, is getting out the vote.

Second story covers that in a way that will infuriate Republicans, but it's their own damn fault:

Thousands of illegal-immigrant youths are at the forefront of national efforts to get immigrant and Latino citizens to the polls next week, the latest demonstration of the increasingly organized and vocal group's power.

In swing states like Florida, Ohio and Colorado, the young people—often referred to as Dreamers after the failed Dream Act legislation that would have offered them a path to citizenship—are running phone banks, going door to door and approaching students on college campuses to encourage voting. They also are active in California, a Democratic stronghold, and Texas, where Republicans have the edge.

The group is targeting Latinos, the fastest-growing electorate in the U.S., whose turnout at the polls is traditionally lower than that of blacks and whites. Polls show an overwhelming advantage for President Barack Obama among Latino voters, but the Dreamers efforts also could boost Democratic support in state and congressional races, supporters and opponents agree.

The revenge of the denied citizens!

We shoot ourselves in the foot regarding Latin America, which, over the long term, is our greatest source of economic growth and ultimately power.

We shoot ourselves in the foot over immigration and drugs.

Immigration is what keeps this country "young." We are mean age 36 right now, but that will rise to just under 40 at 2050, primarily because of immigration and the high fertility associated with that (for the first 2-3 generations). By way of contrast, China, which is also 36 years old now, will reach almost 48 by 2050, which will constitute a huge drag on its economy.

But China's long-term advantage is this: it's surrounded by younger regions poised for lengthy demographic dividends (high proportion of workers to dependents). First there's SE Asia, which will enjoy a demographic dividend on par with China's of the last 4 decades, and then there's India, which will enjoy an even bigger one through mid-century.

Being surrounded by faster growing economies is a sure way to lift your own as growth tapers off due to modernity, advanced status, slowing demographics, etc. So, long term, China gets a lot of help.

We could too via Latin America, if we didn't make the drug war the centerpiece of our foreign policy throughout the hemisphere. Instead, we cede a lot of that growth to others (Europe, Asia) when we should be expanding southward as a center of gravity in free-trade zones and ultimately as a multinational union.

But that will all come with time. We just don't have any political leaders with genuine vision.

But get us to 2050, when one of three US voters will have some Hispanic blood in them? Hmm. Much will change.

Republicans will lose more and more elections until they change their anti-growth tune. They are swimming against the tide called the future.

Thursday, November 1, 2012 at 11:26AM

Thursday, November 1, 2012 at 11:26AM

It's that old Winston Churchill bit about how you can't think ahead into the future any further than you can reach back and remember your past. It's a balancing act.

Neat NYT article on how Turkey is rediscovering its history via film ("As if the Ottoman period never ended.") Nothing says, "growing regional/global ambitions" quite like that.

The Ottoman period, particularly during the 16th and 17th centuries, was marked by geopolitical dominance and cultural prowess, during which the sultans claimed the spiritual leadership of the Muslim world, before the empire’s slow decline culminated in World War I. For years the period was underplayed in the history taught to schoolchildren, as the new Turkish Republic created by Mustafa Kemal Ataturk in 1923 sought to break with a decadent past.

Now, as Turkey is emerging as a leader in the Middle East, buoyed by strong economic growth, a new fascination with history is being reflected in everything from foreign policy to facial hair. In the arts, framed examples of Ottoman-era designs, known as Ebru and associated with the geometric Islamic motifs adorning mosques, have gained in popularity among the country’s growing Islamic bourgeoisie, adorning walls of homes and offices, jewelry and even business cards.

I know a lot of people harbor a lot of fears about Turkey, but I think it's the best thing that's happened to the Middle East in a long time. If we didn't have a Turkey to play lead goose on the Arab Spring, we'd have to invent one.

Bring on the Gallipoli films (all four of them)!

Wednesday, October 31, 2012 at 8:11AM

Wednesday, October 31, 2012 at 8:11AM

From David Brooks in the NYT yesterday: the reality that a Romney presidency compromising with a Democratic Senate would lead to a decent amount of necessary reform (including dropping the Bush tax cuts), while an Obama presidency would lead to very little advance and continue the general political gridlock in DC.

Why?

Romney isn't much of a right-winger. That's all a sales job that's been rather effectively ditched in recent days and weeks to emphasize he'd really rule center-right. If he squeaks in, that's the mandate he'd have. He'd be realistic, as he was in Massachusetts, with the Democratic Senate, and things would get done. Plenty of compromises would follow, and Romney would largely be villified by the far-right - not the far-left.

In truth, Obama isn't much of a left-winger. He'd continue ruling center-left, but the nutcases in the GOP-dominated House would continue doing their best to sabotage all progress, pushing him, in his second term, primarily into foreign affairs as a refuge. For Obama to win, as he looks like he will (just barely), via a very negative campaign, he'll enter office with virtually no mandate. Dems will be happy enough to forestall the GOP nutcases in the House, but we'd be looking at 4 more years of stasis (and no, the complete nonsense sales-job of America going whatever by 2016 under Obama doesn't register with me). Frankly, I think Romney would likely do a far better job of finessing Obamacare (originally, Romneycare) into full existence.

I agree with Brooks' analysis completely. As much as I dislike the vast majority of the Republican agenda, this is my primary reason for preferring Romney to a second Obama term: I see the promise of advance under Romney; and I see virtually no chance of any under Obama.

And I prefer some progress to none - simple as that.

But, in truth, I have no individual say in the matter. Indiana will go Romney by a wide margin, so my vote will be meaningless.

Tuesday, October 30, 2012 at 5:27PM

Tuesday, October 30, 2012 at 5:27PM  Tuesday, October 30, 2012 at 11:49AM

Tuesday, October 30, 2012 at 11:49AM The warning just came in from Squarespace.

Tuesday, October 30, 2012 at 8:38AM

Tuesday, October 30, 2012 at 8:38AM

Interesting FT column by Satyajit Das.

Two important factoids:

There was a time for both countries (US in 1950s and China at end of Cold War) where $1-2 of debt would do.

Then an almost Marxian critique:

Debt became a mechanism for hiding disparities in the wealth distribution within many societies. Increased credit availabiliby allowed lower income groups to borrow and spend, encouraging housing booms, in order to deal with the underlying problem of stagnant real incomes.

A bit skewed in its causality. Credit has always been the mainstay of growth in a capitalist society. Reducing its function to "hiding disparities" is a very narrow view.

The stagnant real incomes problem is hardly universal in this current era of globalization. It is felt primarily in the West, where jobs easily cordoned off from global competition now suffer it greatly. This is the "cost" of letting so much of the world into the global party called globalization. We can decry this, but the cost of our privilieged standard of living in the past was the vast exploitation/disconnection of much of the world, or the have/have-not divide that Europe begat in its previous extension of colonial-globalization.

Is it worth to me to live in a far more just world to suffer this income stagnation?

As a Christian who believes I'm not just here to hoard and tell others to go f#$K themselves, yes, it is worth it.

Did we get addicted to cheap debt in the vast transaction strategy we ran with the world so as to spread the international liberal trade order already deeply embedded in these United States (this multinational economic union)?

We sure did.

Will we eventually run out of new sources of cheap labor in the global economy?

Absolutely. Within my life. But that will be a better problem than today's.

So where do find growth in the future?

The rise of the global middle class - the best thing to ever happen on this planet - will force magnificent resource utilization revolutions. This will dovetail with new environmental challenges (or the exacerbation of old ones). Again, these will constitute our best problems yet.

But massive adjustments must be made to protect the vulnerable amidst globalization's continued rapid expansion. And great investments must be made to bootstrap our national economy into a more realistically competitive shape for the struggles to come.

And that's why higher taxes are coming for the rich in this world. We enter a length redistributionist phase so as to avoid political tumult. It is capitalism's great genius - in combination with democracy - to recognize these moments in history and to address them head-on. Once the oncoming global progressive era works its necessary magic (and no, those ideas and leaders are - by and large - yet to emerge), such a burden for the rich will be less necessary.

But to pretend that tax cuts are the answer now, amidst the populist anger spreading across this planet and in particular this country, is to stay pointlessly dogmatic. There is no one economic theory that rules throughout time. There are seasons for each.

A foolish consistency is the hobgoblin of little minds.

- Ralph Waldo Emerson

Monday, October 29, 2012 at 12:00PM

Monday, October 29, 2012 at 12:00PM Blogged a piece a while ago about how Iranian products just aren't making it in Iraq, while Turkish ones are far more welcome. This FT piece by Daniel Dombey (whom I cite a lot) argues that what the geo-pols consider Turkish empire re-building is undergirded for the most part in wanting to dominate export models (my read of his analysis). Why?

Turkey has hit that middle-class phase where the people want to consumer a lot and thus imports rise - along with consumer credit. Unless you combat that with exports, you end up a bit too much like the US.

Iraq has just overtaken Italy as Turkey's second-biggest export market, with the KRG leading the way.

Turkey has similar eyes for Syria and - ultimately - a post-changed-regime Iran.

These are good ambitions, the best kind of "imperialism" - really: making consumers happier than the crappy regime that lords over them.

Sunday, October 28, 2012 at 12:01AM

Sunday, October 28, 2012 at 12:01AM Very slick. I make a good portion of my living narrating visual explanations (PPT) of complex concepts, and I appreciate a good presentation.

The missing concept here: the trickle-down argument can make sense, in my opinion, in a more closed economic enviroment, or in a national economy less dependent on trade and less subject to international competitive pressures. In today's globalized economy, however, I think it's a distinct beggaring proposition that the supply-siders (and yes, even the Chicago School types) have never admitted - much less figured out. We no longer live in a world where economic philosophies pitched at the nation-state level hold sway. There is a new Washington Consensus to be found.

As somebody who's paid a top-line tax rate for maybe 1/3-1/2 of my adult life, I have to say that I am deeply disturbed by what has happened to the middle class over the past decade, because, as a foreign policy expert, I know that the intolerance and inward-vision bred by flat incomes impacts our power projection capabilities immensely.

I honestly can't see the argument for keeping the Bush tax cuts. Not in our fiscal situation, debt trajectory, and my deep understanding of the progressive-era tasks on our plate. I'm just not that greedy. I want to leave behind a better country for my kids.

I'm made a lot of money across my career and I am no stranger to hard times, so I don't write as someone who's only lived one type of existence. When you make a lot, you should pay a lot - as in, a higher percentage. The Bush tax cuts should go. They are not in our country's best interests going foward.

I don't see it as a way to a strong defence. I don't see it yielding a strong anything.