To me, this is the ideological conflict of the 21st century: money = access to bio revolution = longer lives, so access to tech is self-licking ice-cream cone (I live longer and therefore vote more and - BTW - have more money to spend on politics, which increases my access to tech, which makes me live longer, which ...).

Check it out from WAPO:

ST. JOHNS COUNTY, Fla. — This prosperous community is the picture of the good and ever longer life — just what policymakers have in mind when they say that raising the eligibility age for Social Security and Medicare is a fair way to rein in the nation’s troublesome debt.

The county’s plentiful and well-tended golf courses teem with youthful-looking retirees. The same is true on the county’s 41 miles of Atlantic Ocean beaches, abundant tennis courts and extensive network of biking and hiking trails.

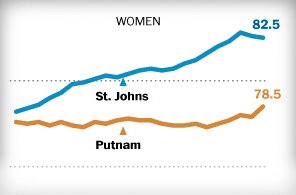

The healthy lifestyles pay off. Women here can expect to live to be nearly 83, four years longer than they did just two decades earlier, according to research at the University of Washington. Male life expectancy is more than 78 years, six years longer than two decades ago.

But in neighboring Putnam County, life is neither as idyllic nor as long.

Incomes and housing values are about half what they are in St. Johns. And life expectancy in Putnam has barely budged since 1989, rising less than a year for women to just over 78. Meanwhile, it has crept up by a year and a half for men, who can expect to live to be just over 71, seven years less than the men living a few miles away in St. Johns.

The widening gap in life expectancy between these two adjacent Florida counties reflects perhaps the starkest outcome of the nation’s growing economic inequality: Even as the nation’s life expectancy has marched steadily upward, reaching 78.5 years in 2009, a growing body of research shows that those gains are going mostly to those at the upper end of the income ladder.

The tightening economic connection to longevity has profound implications for the simmering debate about trimming the nation’s entitlement programs. Citing rising life expectancy, influential voices including the Simpson-Bowles deficit reduction commission, the Business Roundtable and lawmakers on both sides of the aisle have argued that it makes sense to raise the eligibility age for Social Security and Medicare.

But raising the eligibility ages — currently 65 for Medicare and moving toward 67 for full Social Security benefits — would mean fewer benefits for lower-income workers, who typically die younger than those who make more.

“People who are shorter-lived tend to make less, which means that if you raise the retirement age, low-income populations would be subsidizing the lives of higher-income people,” said Maya Rockeymoore, president and chief executive of Global Policy Solutions, a public policy consultancy. “Whenever I hear a policymaker say people are living longer as a justification for raising the retirement age, I immediately think they don’t understand the research or, worse, they are willfully ignoring what the data say.”

So counter-intuitive: raising the age = even more disproportional burden on less weathy.

The segregation is already well underway between the long- and short-lived.

The two counties in FLA:

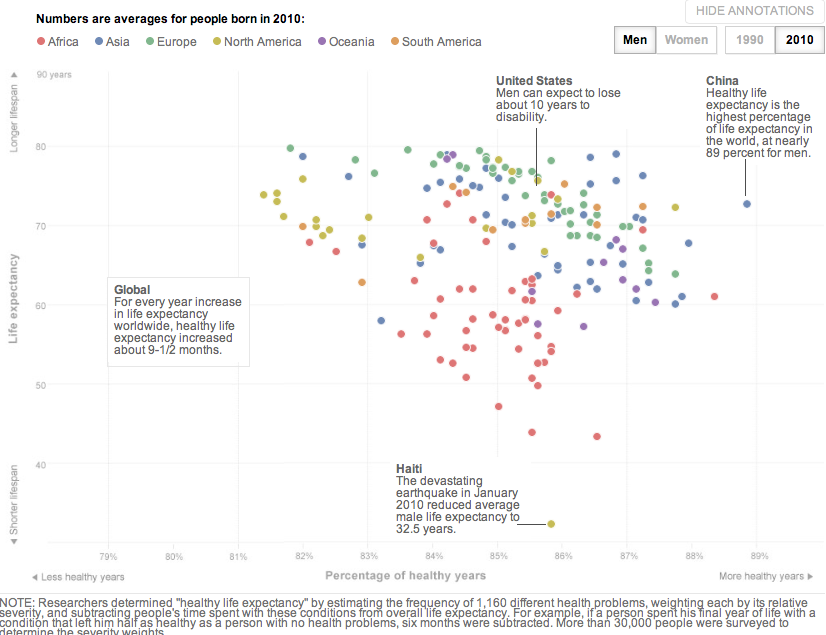

Now globally:

It won't be the "clash of civilizations" in the 21st century, but the clash of generations.