FT story.

FT story.

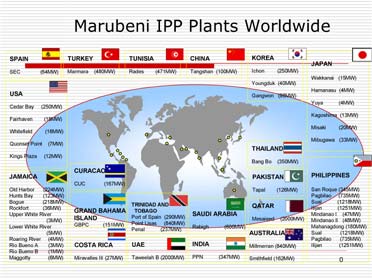

Marubeni is a Japanese trading company. Historically focused on importing energy and raw materials to resource-poor Japan (the map to the right show's the company's global network of independent power producers), Marubeni is also the world's sixth biggest grain trader by volume.

Marubeni's chief exec just announced that he wants the company to break into the top tier, known as the "ABCD group" (for ADM, Bunge, Cargill, Dreyfus and "lowly" Glencore--which apparently doesn't rank a letter). Marubeni's grain traffic has doubled in the last five years, so it's no idle boast.

My thought, which I've been toying around with in the Wikistrat global model, is that global ag markets already resemble energy markets in their tightness of supply and volatility of price, so, when you consider that France-sized chunk of arable land that's been taken off the market over the past few years through purchases and leasing, can't we start talking about the rise of National Food Companies, or companies that have, as their guiding logic, the securing of food networks abroad for a primary national customer back home?

Economist chart found here.

I mean, when China or Saudi Arabia sign these contracts, I gotta bet we're talking investing entities with some serious ties to the government - advertized or not.

Actually, Marubeni's ambition reflects a region-wide focus, since China is already its bigger market. What's especially interesting about its ambition is how Marubeni uses its grain trade to get into ancillary markets like milling and animal feed processing.

Just got me thinking . . .