FT op-ed

FT op-ed

The fear of a lost decade in the Old Core (a la Japan in the 1990s) must be dealt with by seeing the bottom-of-the-pyramid (that neo-Marxism-killing concept) potential staring us in the face.

Again, the Core survives by integrating the Gap and increasing prosperity there. That's the dominant system impulse right now: globalization must expand further to keep on prospering. Shrink the Gap: there is no alternative.

Zoellick:

Riots, debts and the creeping fear of a looming Lost Decade - no wonder there is pessimism in Europe. But what we are seeing is not just "financial crisis, part two"; it is "sustainable growth challenge, part one". The difference has implications for policy. Get the diagnosis wrong and the wrong treatment will follow.

Stimulus packages buy time--nothing more.

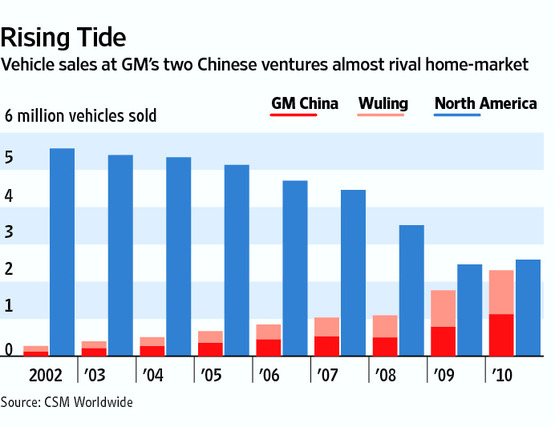

To avoid a decade-long work-out - with political and economic risks - the world needs stronger growth in developing and developed countries. We are seeing a shift towards a new multi-polar global economy, with better prospects in developing countries than in developed ones. The World Bank projects growth in developing economies of about 6 per cent this year and next - more than twice that of high-income countries. Since 2000, developing countries have accounted for more than half the rise in global demand for imports.

This is not about winners taking all. An acceleration of this shift can help developed countries work out their problems while building a better-balanced global system. A dollar spent on investment goods in developing countries can yield 35 cents worth of demand for capital goods produced in high-income countries, precisely the kind of high-value goods that generate well-paying jobs.

As for de-globalization and retreating from connectivity and seeking refuge in more state-ownership? Complete bullshit:

Financial crises can spur reform. Last year as developed economies focused on Keynesian changes in demand, Asia-Pacific economies were advancing reforms - especially in services - to generate higher growth. As developed economies focused on financial regulation and a broader reregulatory movement, Asians were considering how deregulation might foster innovation and jobs.

Developing countries have understood that a sustainable recovery depends on reviving the private sector. Businesses will invest if the policy environment enables them to turn a profit. More governments implemented regulatory reforms to make it easier to do business in 2009 than in any year since 2004, with nearly 300 reforms registered worldwide. Most occurred in developing economies.

In "sustainable growth challenge, part one", it is not about unmitigated austerity, but finding sustainable paths to prosperity. The EU and developed countries elsewhere need more than fiscal stringency, especially if achieved by piling on more taxes. They need to seize opportunities from growth in developing countries to avoid their own lost decade. There is a broader lesson: in 2008, the crisis was US-led; in 2010, it is European. For both the US and Europe, it is developing countries that point to the way ahead. It is time we took note.

As always, the smartest guy in the room.

Nothing confuses like success. We don't realize how successful we've been in institutionalizing--on a global scale, our American System-cum-international liberal trade order-cum-the West-cum-the global economy-cum-globalization. It is the gift that keeps on giving, and our disciples now outrank us in the ferocity of their beliefs.

These are the best problems we could hope for at this point in history.

Eyes on the prize, boys, eyes on the prize.

Saturday, July 28, 2012 at 10:52AM

Saturday, July 28, 2012 at 10:52AM  WSJ story on multinationals finding steady profit in marketing to the poor, who offer a "relatively stable demand":

WSJ story on multinationals finding steady profit in marketing to the poor, who offer a "relatively stable demand": That was C.K. Prahalad's Bottom of the Pyramid logic that was first opposed, then ridiculed and now gets passed off as the conventional wisdom of the analysts.

That was C.K. Prahalad's Bottom of the Pyramid logic that was first opposed, then ridiculed and now gets passed off as the conventional wisdom of the analysts. bottom of the pyramid,

bottom of the pyramid,  development | in

development | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article