The elder entitlement conundrum: raising retirement age doesn't get you what you want

Monday, March 11, 2013 at 10:08AM

Monday, March 11, 2013 at 10:08AM To me, this is the ideological conflict of the 21st century: money = access to bio revolution = longer lives, so access to tech is self-licking ice-cream cone (I live longer and therefore vote more and - BTW - have more money to spend on politics, which increases my access to tech, which makes me live longer, which ...).

Check it out from WAPO:

ST. JOHNS COUNTY, Fla. — This prosperous community is the picture of the good and ever longer life — just what policymakers have in mind when they say that raising the eligibility age for Social Security and Medicare is a fair way to rein in the nation’s troublesome debt.

The county’s plentiful and well-tended golf courses teem with youthful-looking retirees. The same is true on the county’s 41 miles of Atlantic Ocean beaches, abundant tennis courts and extensive network of biking and hiking trails.

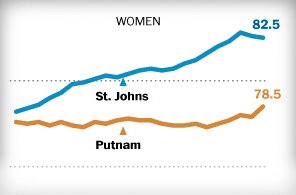

The healthy lifestyles pay off. Women here can expect to live to be nearly 83, four years longer than they did just two decades earlier, according to research at the University of Washington. Male life expectancy is more than 78 years, six years longer than two decades ago.

But in neighboring Putnam County, life is neither as idyllic nor as long.

Incomes and housing values are about half what they are in St. Johns. And life expectancy in Putnam has barely budged since 1989, rising less than a year for women to just over 78. Meanwhile, it has crept up by a year and a half for men, who can expect to live to be just over 71, seven years less than the men living a few miles away in St. Johns.

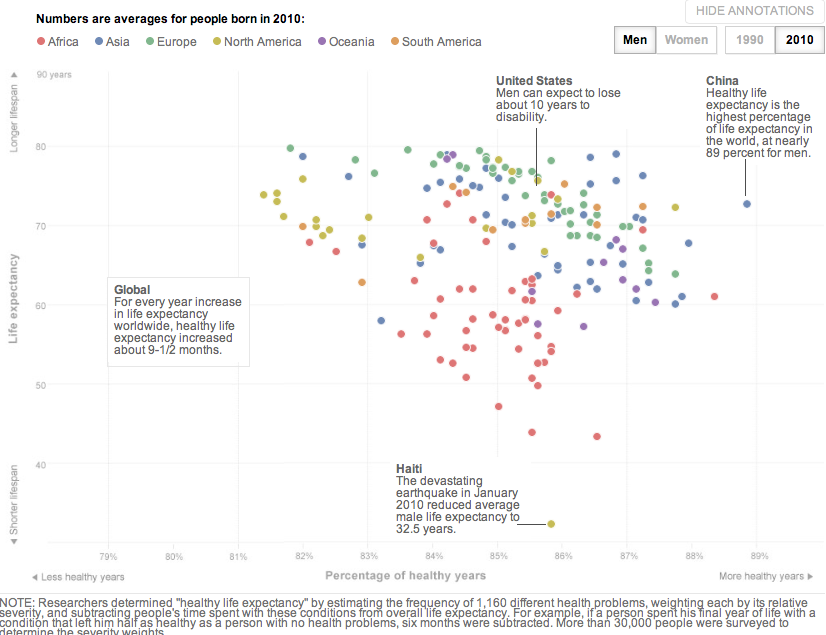

The widening gap in life expectancy between these two adjacent Florida counties reflects perhaps the starkest outcome of the nation’s growing economic inequality: Even as the nation’s life expectancy has marched steadily upward, reaching 78.5 years in 2009, a growing body of research shows that those gains are going mostly to those at the upper end of the income ladder.

The tightening economic connection to longevity has profound implications for the simmering debate about trimming the nation’s entitlement programs. Citing rising life expectancy, influential voices including the Simpson-Bowles deficit reduction commission, the Business Roundtable and lawmakers on both sides of the aisle have argued that it makes sense to raise the eligibility age for Social Security and Medicare.

But raising the eligibility ages — currently 65 for Medicare and moving toward 67 for full Social Security benefits — would mean fewer benefits for lower-income workers, who typically die younger than those who make more.

“People who are shorter-lived tend to make less, which means that if you raise the retirement age, low-income populations would be subsidizing the lives of higher-income people,” said Maya Rockeymoore, president and chief executive of Global Policy Solutions, a public policy consultancy. “Whenever I hear a policymaker say people are living longer as a justification for raising the retirement age, I immediately think they don’t understand the research or, worse, they are willfully ignoring what the data say.”

So counter-intuitive: raising the age = even more disproportional burden on less weathy.

The segregation is already well underway between the long- and short-lived.

The two counties in FLA:

Now globally:

It won't be the "clash of civilizations" in the 21st century, but the clash of generations.

US,

US,  demographics,

demographics,  global trends | in

global trends | in  Citation Post |

Citation Post |  Email Article |

Email Article |  Permalink |

Permalink |  Print Article

Print Article

Reader Comments (8)

Spent yesterday with a friend discussing this issue in the context of retirement emigration. Two mitigating factors may rejigger the playing field. Emigration to countries with significantly lower cost of medical care. ($1000 per month will afford two full-time well-trained live in home health workers in Thailand.) Also, much of the benefit of IT (even in the health sector) is not accounted for in the GDP because of network effects (and other factors). Everyone benefits when we all have reporting bots in our bodies. The rich always lived longer and better because they could control the nonrandom killers. I'm not sure the future will be much different from the present.

I don't think this is a reason to completely reject indexing retirement to longevity, but rather creating a more comprehensive index that also factors in socio-economic background and occupation classification. Blue collar jobs that are more physically demanding should earn earlier retirement age. But average lifespan was below the retirement age when SS was started and wasn't designed with increasing lifespans in mind. That's a poor design, and it's not sustainable even with short term fixes like cap elimination and means tested benefits. Does anyone think that lifespans are going to not continue to increase with advancements in medicine and nutrition?

Part of the issue is that society was probably a bit more homogenous in its makeup when these programs were designed. Globalization, immigration and uneven distributions in education have created a more diverse society that requires more intelligently designed social programs.

Well the answer to the demographic problem and clash of generations is very easy: Just kill the poor older generation that you don´t have to sudsidize them! There wil be a coalition of the young and the rich old people to get rid of the poor old people. Not a clash of generations, but a coalition between the youger employed generation and the rich old generation. It will be a mass euthanasia programme for the poor old people. We will see horrible scenes in the future to come!!!

Part of the problem is that different professions age their practitioners at different rates--are they lower-income because they're shorter lived or are they shorter-lived because they wrecked their bodies with physical labor? A better approach might be to drop the concept of retirement age altogether and treat pensions like a form of disability. Not only does that allow for people to retire when they need to, it encourages society to research medical and other means of extending workers' shelf-lives.

are these life expectancy numbers from birth? there is a huge statistical difference between the life expectancy IF you reach 65 or from birth. I dug through the WAPO article, it seems to be a mix of uses.

I come from law enforcement where there is mandatory retirement. We are facing problems with our pension funds because of increased life expectancy. In the 1940's men paid into the funds for 30 years. They only lived for 5 to 7 years after retiring. Easy math. Pay in for 30...take out for 5. Now officers not only want to retire earlier, they are going to live much longer. The math is not working. I have been on the mean streets. Been in my share of battles. It's no place for someone in their 60's. There are other occupations that favor the young and the swift. And let me add this for you younger lads who are still working. The idea that you need less money when you are retired is a myth.

This is the problem with Social Security, when viewed in separate parts, is a program that its supposed proponents would find unconscionable.

There is a "payroll tax" up to a maximum, so, a regressive tax. Also, even right after its passage, the program IN THE PAST had the same regressive effect on the poor. Since poorer people tend to live shorter and work longer than wealthier people, it has always tended to be a regressive system. One of the famous memes on social security's financial viability was people died before they could collect, or died soon after, especially poorer, high risk workers.

I have always been in favor of abolishing social security in return for a graduated minimum income system....which would truly be "Social Security." In fact, I'd replace the entire "welfare bag" with this system, similar to the EITC on the tax form.

SSc= A political solution by Politicians seeking votes, and then robbed by the next generation of Politicians of any assets in order to further their political ambitions. There has never been any sensible planning involved, and at this point is probably beyond any rescue . .

Simply put, it's the country finding out it didn't put enough money away to retire on . . and the broker we trusted spent what little we would have had . .