Nice FT story on what Shell is saying about natural gas in the US. Current Henry Hub price has been hanging around $2.25-2.55, which is about 3-4 times cheaper than Europe MMBTU (millions British thermal units) and bizarrely cheaper than most Asian countries are being quoted right now (more like $14-15 and moving north for the summer to almost $20 - by some predictions).

Think about that for just a second. Natural gas in the US at something like 1/8 the price in Asia. How long do you think that lasts? Why should it?

To me, that's a huge LNG (liquid natural gas) market waiting to be captured by US producers. Selling LNG ain't like moving 100,000 metric tons of diesel or jet fuel or 2 million barrels of crude in one large tanker. Those transactions are the equivalent of one-night stands and leave your money on the dresser. Selling LNG is more like getting married: the buyer has to have a relationship with a regasification terminal nearby. There must be pipes that connect the end-user to that LNG terminal (only so many in the world, but plenty being built). If no regasification terminal, then buyer needs to rent himself a regas ship ($50m a year), park it somewhere, and then connect that by pipes to the end-user. All very complex.

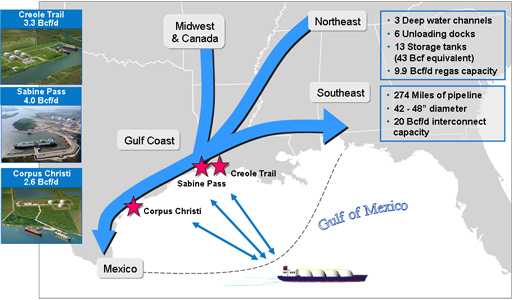

Of course, the seller must have liquefaction facilities at ports, with pipelines connecting fields.

America is piped up like crazy and adding more pipe all the time. We're just getting our first for-export liquefaction facility set up in Louisiana by Cheniere, which is leading the effort here to gear up for export.

All very exciting stuff, as we could be exporting - within a few years - upwards of 1/4 of our production. Then you factor in all the coal displaced in electricity generation, and we can be exporting that high-quality stuff to Asia along with the LNG - a win-win on trade balance and energy security.

Back to the FT piece: the currently depressed US prices are just too low, reflecting that we're running out of storage after a mild winter and a continued production boom. Shell's prediction? US NG prices will double by 2015. Expect the petrochem industries to hawk that fear like crazy, but in truth, it's a reasonable rise to just $4-6 MMBTU.

[Shell, BTW, has done a lot of exploratory drilling on NG in China and says it thinks the reserves can be developed economically.]

Shell is also "examining plans to liquefy US gas for export - which would allow it to attract higher prices, particularly in Asia - transform it into clean-burning transport fuel through gas-to-liquids technology, and use it as a feedstock for petrochemicals." That's a quick rundown of the range of economic opportunities - in addition to displacing coal in electricity.

All good stuff and an integral part of America's coming industrial renaissance.